INSURTECH INSIGHTS

Know How To Protect Your Insurance Career In An AI Era? Ignore This

Building Your Career in the AI Era of Insurance Requires A New Strategy It’s easy to get overwhelmed with all of the hype about AI and tune it out. What’s true is that none of us really know all the ways AI will impact our lives and careers and, for that matter, what to do

Gen AI is Here. What’s Next For Insurance Careers?

Welcome to The Great AI Transformation AI is not just a technological advancement; it’s a transformative force reshaping how value is defined, created, and delivered in the insurance industry. This transformation extends beyond technology, redefining the insights and skills insurance professionals need to stay relevant and competitive. Whether you work in sales, marketing, underwriting, claims,

Building a Career Edge In the AI Insurance Era: Demystifying The AI Genie

Artificial Intelligence (AI) is rapidly transforming industries worldwide, and the insurance sector is no exception. To stay competitive and advance your career, it’s crucial to develop a deeper understanding of AI and its impact on our industry.

Assessing Leadership Proficiency in an AI-Driven Insurance Era

The rapid adoption and increasing capabilities of Artificial Intelligence (AI) require new competencies in leaders throughout their organization. Do your leaders have them? Keep reading to find out.

Benchmarking Insurance Leaders’ AI Readiness

Artificial intelligence (AI) is rapidly reshaping insurance. The role of decision-makers is more crucial than ever. Beyond merely adopting AI as a technology, leaders must prepare their organizations for the next wave AI innovations. Innovations that will redefine the industry. How ready are your leaders?

Preparing Now for AI’s Next Evolution: A C-Suite Imperative For Health Insurers

While health insurers are prioritizing enhancing customer experiences, modernizing legacy systems, and organizing data, a vital strategic focus is often overlooked: preparing their organizations for the next even more powerful waves of AI Innovation.

The AI Shift: Evaluating The Real Competitive Landscape

Understanding the competitive landscape in the AI era is critical for insurance executives. It’s important to see beyond traditional competitors. It’s about strategically understanding how AI will disrupt the industry and identifying how digital leaders and new entrants will leverage the technology. More importantly, it’s about understanding how to give your company a strategic edge

Life Insurance, Global Mega Trends, And AI Strategy: Next Steps For Execs

Global megatrends are not just reshaping the world at large; they’re fundamentally altering the insurance landscape. It’s a transformation driven by emerging technologies, climate, changing demographics, evolving consumer expectations, and a new focus on sustainability. As AI becomes increasingly central to this reshaped world, life insurance leaders face an urgent task. Strategically integrating AI to

AI Isn’t Just A Technology – It’s A Business Strategy. Here’s Why

In an era where AI is literally redefining industries, insurance executives who see AI as mere technology rather than a core driver of future business strategy are putting their business at risk. Over the next 3-5 years, AI will permeate almost every aspect of insurance. This includes Customer Engagement, Marketing, Underwriting, Claims, Real-time Data retrieval,

Becoming A Life Catalyst for Gen AI: Data & AI Strategies for the New Norm

Our incoming customers, the Digital Natives, soon to become Gen AI, are at the threshold of a future brimming with unprecedented risks, changes, and opportunities. As life and group benefits providers, we are uniquely positioned to step into the role of Life catalysts, guiding these AI Natives through the evolving landscape of new norms and

AI-Powered Value Added Services: Insurance’s New Competitive Bar

P&C insurance’s competitive landscape is shifting rapidly as companies compete to offer value-added services beyond traditional coverage. The arrival of AI-native consumers—reshaping expectations in the wake of ChatGPT’s explosive growth to over 180 million users—is about to accelerate this trend and deepen it’s competitive impact.

AI The Next Competitive Frontier in P&C Insurance

The property and casualty (P&C) insurance landscape is undergoing a monumental shift driven by advanced technological forces. Today AI is taking the lead. In an era where experiences outside the industry shape customer expectations, P&C insurers must adapt with agility and focus to not just stay relevant but to lead in a competitive market.

Navigating Emerging Risks: AI and Data-Driven Strategies for Execs

Personal and commercial customers of P&C insurance face a range of emerging risks over the next 10 years. The increasing use of technology and digitization means that cyber threats, such as data breaches and ransomware attacks, will become common. Climate change intensifies natural disasters like hurricanes, wildfires, floods, and other extreme weather events. The widespread

Digital Natives and AI: Changing Customer Expectations

Customer expectations driven by Artificial Intelligence (AI), digital natives, and Gen Z consumers are reshaping our industry. Here are the key insights.

The AI Insurance Leadership Evolution: New Skills Required

In the next several years, the criteria for promoting people into management and leadership roles in insurance will profoundly change. Those individuals will be the ones with a demonstrated ability to harness the power of AI while and have adapted their leadership and management approaches to this new reality. If you intend to be one

Harnessing ChatGPT: Moving From Hype to Strategy. An Executive Guide

The buzz around AI, especially ChatGPT, is almost deafening in today’s rapidly evolving digital landscape. But beyond the hype lies immense strategic potential. This article helps executives understand what ChatGPT is and how it works. This insight will enable them to assess where and how it can help them build a strategic advantage for their

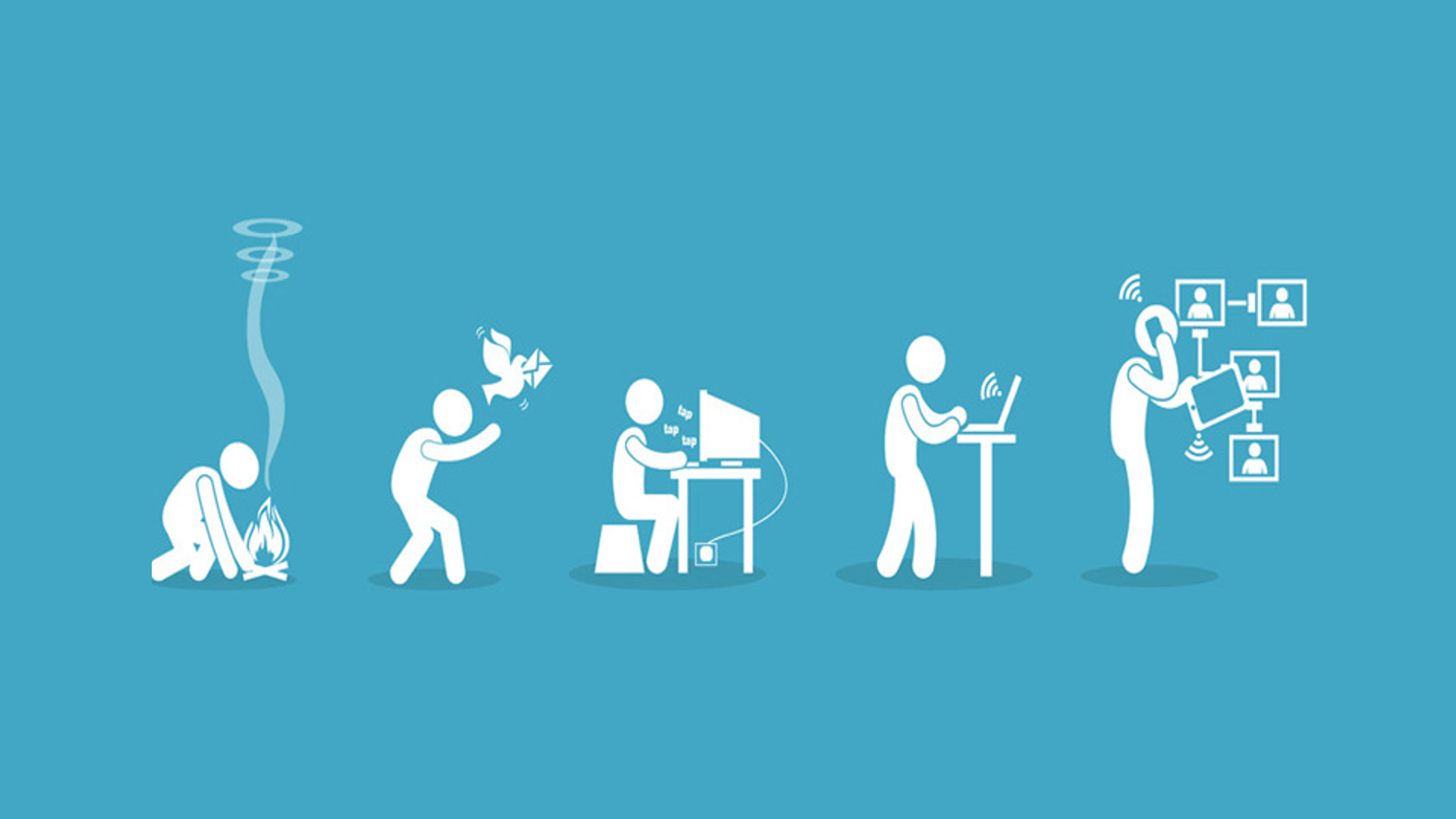

Inside The AI Economy: How Tomorrow’s Insurance Will Differ Significantly From Today

The AI revolution is not merely a technological advancement; it catalyzes a profound global shift in both social dynamics and economic paradigms. Among the industries significantly impacted by this transformation is insurance. Here’s how.

Inside the Coming AI Revolution in Insurance

The age of AI in the insurance sector has arrived, fundamentally redefining every facet of the industry. This transformative technology presents challenges and opportunities for insurers. At the core of this transformation is AI’s omnipresence, weaving itself into every operation, from risk assessment to claims processing. This isn’t just about implementing technology; it’s about reimagining

Rethinking Insurance Leadership in the AI Era

Insurance leaders are at a pivotal point in a world being transformed by AI (artificial intelligence). The question is, how can they lead slow-to-change companies through such profound and swift socio-economic transformations? The answer. Rethinking insurance leadership for the AI Era.

Designing Next-Gen LIfe and Voluntary Benefits Apps with Chat GPT: A Case Study

What can you get out of a 40-minute brainstorming session with Chat GPT on how to design a future generation of insurance solutions? Read the case study.

The Future of Life Insurance: Personalized, Digital-First Experiences for a New Generation

The needs and expectations of your customers, particularly younger generations, are changing rapidly. To remain competitive, your company and others must adapt to these new realities. Here’s how.

Unlocking The Next Generation of Life Underwriting: Personalized, Preventative, AI Powered

The life and voluntary benefits industry is transforming rapidly. Traditional underwriting approaches can no longer meet new customer expectations and market trends. Personalized underwriting, tailored to each customer’s unique needs and preferences, is the future, driving growth, profitability, and satisfaction.

Introducing WealthHacks: A Game-Changing App for Life and Voluntary Benefits

Insurers must evolve or perish, as Gen Z & Alpha demand innovation. Explore “WealthHacks,” a hypothetical app revolutionizing wealth management. This story offers vital insights for executives seeking a competitive edge.

Unlocking The Future of Life Underwriting: Next-Gen AI – A Roadmap

Life and health Underwriting is going through another technological and customer-driven revolution. A new generation of AI, IoT, other emerging technologies, and customers is driving it. The next generation of underwriting will be more accurate, efficient, and personalized. Here’s what it takes to be part of it.

Revolutionizing Insurance: Next-Gen Customer Experiences for a Hyper-Connected, Sustainable Future

The Customer Experience in Insurance is about to undergo some significant changes. Shifting customer expectations, cutting-edge technologies like Chat GPT, Behavioral Science, and advanced IoT devices are driving the change. What will they look like, and what will it take to develop them? Let’s look at three exciting examples—EcoDriveGuard, HealthSync, and ClimateShield.

Future-Proofing Life Insurance: Designing Solutions for Gen Z and Alpha

Crossing The Generational Chasm. The unique needs of Gen Z and Gen Alpha give those willing to step up the ability to seize the industry’s future. If you wait, you risk being left behind. What opportunities and characteristics will shape life insurance solutions and captivate these generations? Read On.

From Disruption to Opportunity: Driving Innovation with Emerging Risks in Life Insurance

The life insurance industry faces emerging risks that present challenges and opportunities as the world becomes more complex and interconnected. Insurers must adapt quickly to risks like climate change, pandemics, cybersecurity threats, social change, and economic instability. When combined with solutions that address the needs of Gen Z & Alpha, they open the door to

Designing the Future of P&C Insurance with 2nd-Gen Connected Products

The P&C insurance industry is at a turning point. With low growth rates and intense competition, P&C insurers must rethink their business strategies. Next-generation connected insurance products need to be a part of that. Here’s How.

The Competitive Edge: How Integrated Insurance Solutions are Changing the Game

Today’s customers seek more than a digital front end to legacy policies. They want a holistic, integrated solution that meets their unique needs and provides them peace of mind.

Josh and Sarah an Insurance Customer Experience Story

We’d like to invite you into a story about Josh and Sarah, a young couple living on a farm just outside of Nashville just a few years from now. As they start planning their business, they realize they need to figure out what kind of insurance they need personally and professionally, and for the business

Competing for The Future: Digitally Native Commercial Insurance Solutions

Imagine a future suite of digitally native commercial insurance solutions. Solutions that leverage advanced technologies such as AI, IoT, blockchain, and cloud computing. Personalized solutions that provide real-time risk management and interoperate with a digital ecosystem of value-added services. That future isn’t too far away.

Competing For The Newest Generations of P&C Insurance Buyers

Traditional P&C Products Aren’t Going to Cut It. A new generation of P&C insurance customers is entering the market. Digital Leaders understand that conventional products aren’t going to cut it and are doing something about it.

Competing for The Future of Life and Voluntary Benefits. It’s Personal

The future of life insurance and voluntary benefits products will be shaped by insurers capitalizing on changing customer profiles and expectations and emerging trends and technologies. Those insurers are creating new and innovative solutions. Solutions that are more personalized, accessible, and convenient. Companies need to act now if they expect to thrive in the digitally

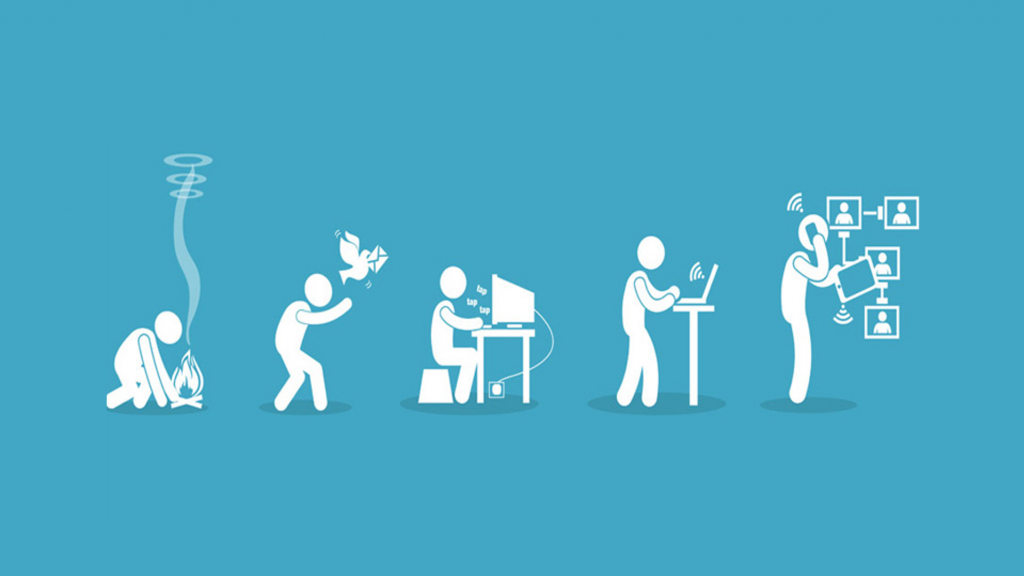

Insurance 2.0: A Survivors Guide

Digital adoption had been accelerating across every aspect of our lives. Then COVID kicked that into hyperdrive. Couple that with macro trends like climate change, shifts in consumer lifestyles, values, and demographics, and you have the makings of a perfect unpredictable storm of change. To survive this digitally supercharged storm over the next 3 years

Why Its Time to Prepare Now for the Data & Analytics-Driven Future of Insurance

Use of emerging data & analytic technologies is accelerating. Insurers need to prepare now for the future that will bring.

The 2021 Insurer Mandate: Accelerating Digital Transformation 2.0

COVID has accelerated adoption of a more holistic, integrated, and customer-centric generation of Digital Transformation. If insurers expect to compete in a market thrown 5 years into the digital future by COVID they need to be on Digital Transformation 2.0 On-Ramp now.

Platform Systems: Foundation for Agility, Speed, and Innovation

Innovation & Agility = Insurer Survival. COVID rocked our world. Normal family, community, and business practices turned upside down. Insurance operations that relied on paper and in-person interactions obsolete. Surviving requires innovation and agility. Without an enabling platform, it’s impossible. That’s why every insurer needs to build an innovation scorecard.

What Does It Take To Be Transformative?

Incremental improvements are table stakes in an increasingly digitally competitive insurance market. To remain competitive requires being truly transformative.

Blend Culture Change and New Tech for Success with Digital Transformation

Digital transformation is not about technology. Yet, isn’t that where we tend to focus? It is too easy for us as insurance business and IT leaders to fixate on technology problems and solutions and overlook the most critical (and more difficult) changes that must take place if we are to transform our organizations…changes in attitudes,

Life Insurers Can Provide Better Insurance To Next Gen Customers

Life insurers are faced with unprecedented challenges in terms of finding new profitable growth opportunities. Many of those opportunities are trapped within the customer data they already have. Minning that data may be easier than they imagine.

Automating Commercial Lines Submission Intake and Underwriting with AI

According to Accenture, on average only 25% of an underwriter’s day is spent on selling and broker engagement, while more than 50% is spent on core processing and repetitive tasks like data entry. Imagine if underwriters could spend more time with brokers and customers, and focus on delivering a better customer experience instead of being

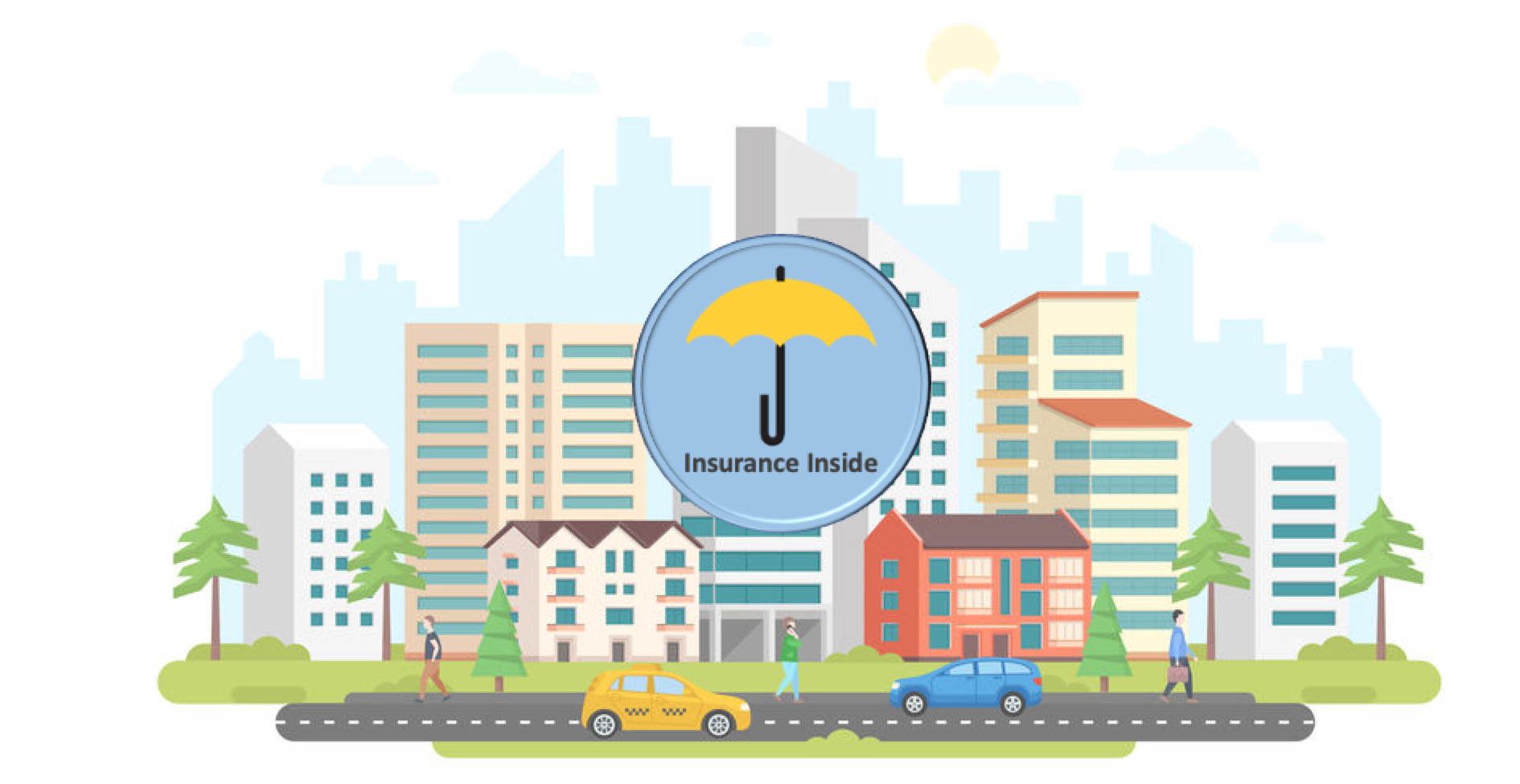

Embedded Insurance: Simple, Transparent, Game-Changing

Nobody wants to buy insurance. It is hard to understand, related to a future risk that is hard to imagine, and relative to that risk seems arbitrarily expensive. Topping that off is an often frustrating, burdensome, heavily paper and people-intensive process. Overcoming that would be game-changing. Meet the Embedded Insurance Innovators.

Digital Insurance & Speed to Market – It’s Time to Get Your Game On

Covid-19 is rapidly changing our world. It’s accelerated the digital transformation of our society, businesses, and personal lives by at least 5 years. The digital leaders in insurance are responding by accelerating their own digital transformation and initiatives. What that means to fast followers and laggards is that if you expect to survive the 2

Why The Customer-Centric Agency is the Future

The agency model has unique, structural advantages over direct writers and lead-gen platforms in insurance distribution in that it is best aligned with consumer desire for objective, transparent, and trusted advice for their risk management needs. A customer-centric agency that can deliver efficient customer acquisition, a frictionless shopping experience, and trusted, ongoing advisory services can

COVID’s Digital Mandate: Insurers Double Down on Transformation & Innovation

Over the past months, I’ve been in conversations with multiple carriers, tech vendors, and InsurTechs. In the early days of COVID, it was all hands on deck to protect employees and to care for customers during the quarantine. While there is still work to do in those areas the conversation has shifted dramatically in the

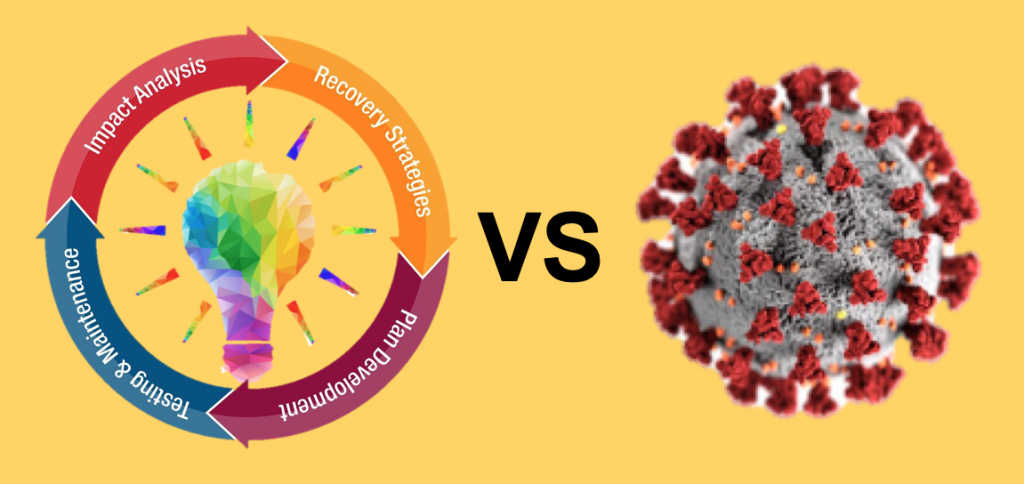

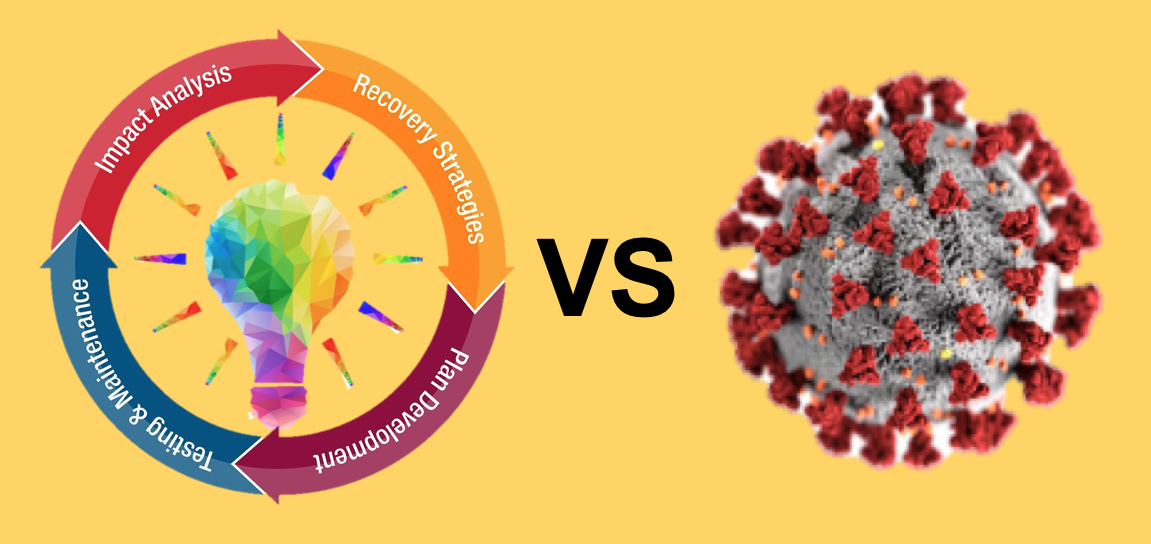

The COVID-19 Imperative: Risk Management, Business Continuity Planning, & Innovation

Digital innovation is no longer just a nice to have; it’s a must-have. It’s no longer just about reducing costs or improving margins; COVID-19 has shown that it’s now an imperative addition to risk management processes and business continuity planning (BCP) as well.

What’s Next for P&C Customer Engagement?

P&C customer engagement is changing. That change driven by InsurTechs and Big Tech firms engages customers personally through the use of big data, AI & ML, awesome UX design and back end systems purpose-built to support this kind of engagement. That’s just the first wave. What’s coming next as these companies tap deeper into the

COVID-19 & Insurance: Impact, Response & Innovation

COVID-19 requires our industry to move immediately to meet insured’s needs and protect our companies and employees. Then we need to take a breath and think. Necessity is the mother of Innovation, and now is the time to put our capability as an industry to innovate to work. Here’s how.

Next-Gen On-Demand Insurance Solutions – High Impact Change Agents – Act Now

On-Demand Insurance - A powerful change agent shaping the future of insurance. Don't miss the opportunity to leverage the knowledge and insights building one offers.

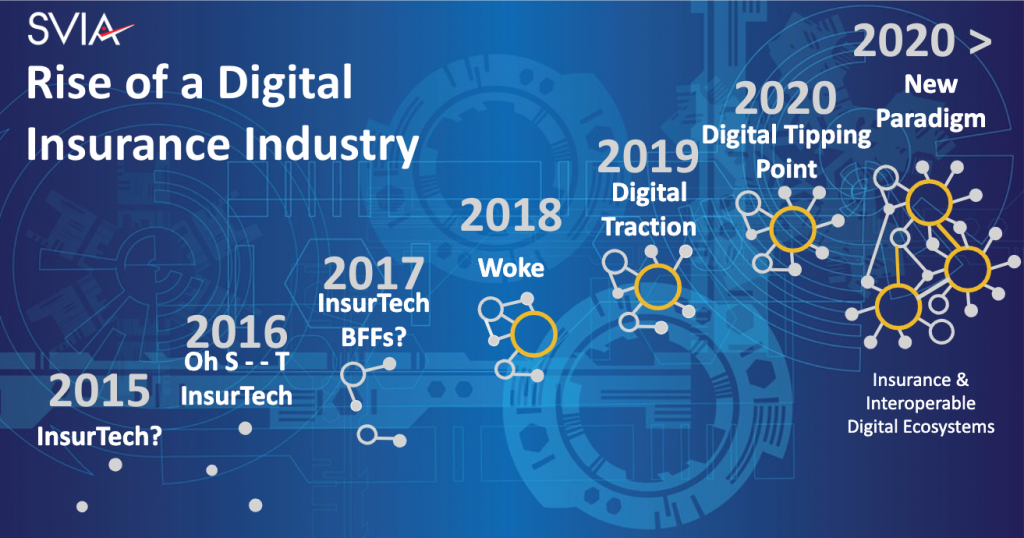

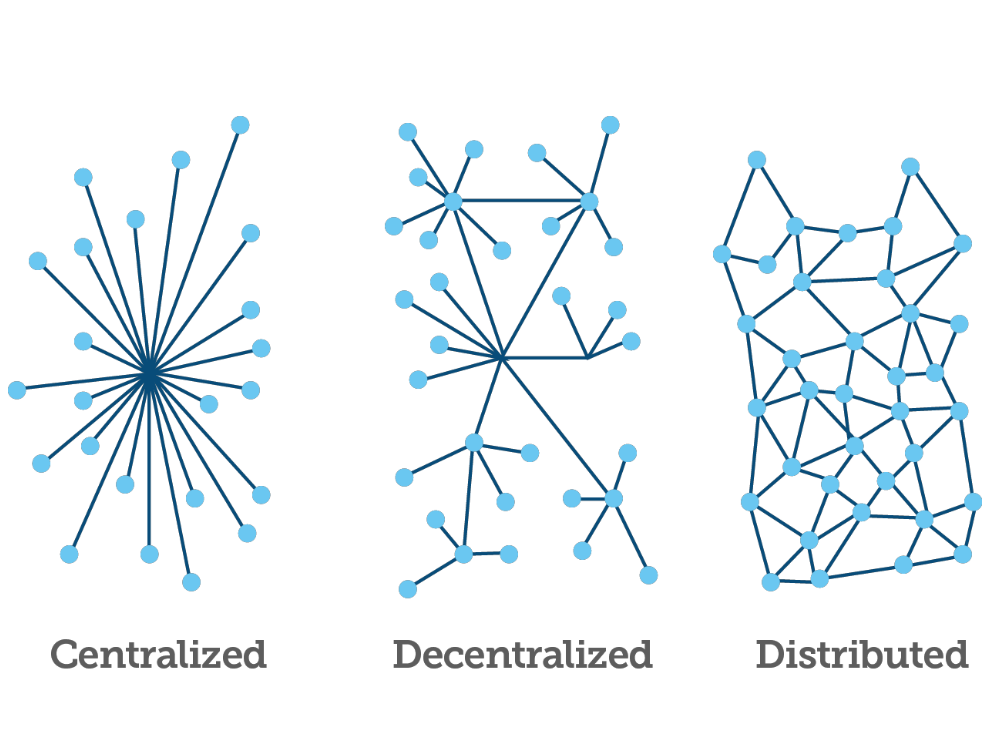

Insurance Core Systems: Requirements for a Digitally Connected World

Competing in the digital insurance industry places new requirements on just about every aspect of insurance. An area that will see major changes is the requirements insurers use to define the digital and legacy system transformations. Digital Ecosystems in particular demand a new approach to core system architecture and capabilities.