The future of life insurance and voluntary benefits products will be shaped by insurers capitalizing on changing customer profiles and expectations and emerging trends and technologies. Those insurers are creating new and innovative solutions. Solutions that are more personalized, accessible, and convenient. Companies need to act now if they expect to thrive in the digitally competitive industry those companies are forming.

The products they deliver will be designed to meet the unique needs and preferences of individual policyholders. They will take the work already being done with wearables and health-tracking devices to the next level. This new generation of products will be more digital and accessible, leveraging online platforms, mobile apps, and chatbots to provide a more seamless and convenient experience for policyholders. These new solutions will provide innovative ways to help customers address emerging risks like cyber security and climate change.

They are also evolving and innovating the customer experience. Leading insurers will leverage technology and data to provide real-time support and assistance to policyholders. And they will enable policyholders to adjust coverage as their needs and circumstances change.

New business models and platforms will be used to increase collaboration between insurance providers, brokers, and employers to create more comprehensive benefits packages that meet the needs of a diverse workforce.

And finally, these leading-edge Insurers will leverage these new capabilities and data to more effectively manage costs and improve operational efficiency while delivering better value for policyholders.

Capitalizing on Trends

Personalization has taken off across multiple industries. Customers have come not just to expect it but demand it. Digital leaders are leveraging that demand to create tailored insurance products that leverage a new generation of data analytics and wearable devices.

They are also capitalizing on a new generation of Ai and chatbots. Those capabilities not only help them increase customer engagement and satisfaction they also increase operational efficiencies.

Customers are increasingly interested in health and wellness offerings. Leaders are expanding their offerings, creating more comprehensive benefits packages for a more diverse workforce. They are also providing solutions that make incentivize collaboration between insurers, brokers, and employers

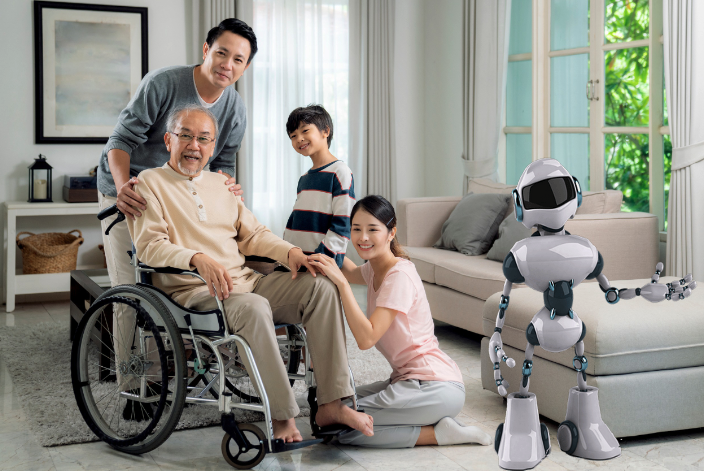

Welcome to a new generation of Life Insurance & Voluntary Benefits Buyers

This new generation is more tech-savvy. They expect and demand digital, automated, and mobile solutions for researching, buying, and managing life insurance policies and voluntary benefits They are also aware of their diversity and expect more personalized and flexible solutions. Digital insurance leaders are capitalizing on this.

These new buyers are also more value and socially conscious. They expect transparency as they research products. That includes not just being able to quickly determine which solutions provide a high level of protection at a reasonable cost but also which products and companies support their values in terms of social and environmental impact, as well as corporate social responsibility and ethical investing.

They want the companies that provide them with goods and services to empower them. That translates into the demand to be more involved and more educated in the insurance buying process, the ability to achieve their life goals and their wellness, and to control their policies.

These buyers are also more risk-aware – they have a growing interest in financial planning and protection.

Finally, they are far more connected. They want more interaction and engagement with their insurance providers, from personalized advice and support to 24/7 access to customer service and claims processing.

Design Thinking: It’s About The Customer

Digital leaders are using design thinking to create a new digital generation of solutions. They are putting the customer at the center of the design process, from research to ideation, prototyping, and testing. By using a continuous cycle of ideation, testing, and refinement, they are creating solutions that better meet customer needs. To accomplish that, they are using multidisciplinary teams. Those teams include experts from a range of fields, such as design, engineering, data science, and business strategy. The result will be more innovative and holistic solutions.

The other thing leaders are capitalizing on are Data-driven insights. They are leveraging new and ever more real-time data sources and analytics to gain deeper insights into customer behavior, preferences, and needs. With that information, they are developing more personalized and targeted solutions.

Other key elements of the Design Thinking process are Empathy and experimentation. Using empathy to understand the customer’s perspective and experimentation to test and validate their assumptions and designs enables them to deliver products and an experience that better meets the individual’s needs.

So, What’s It Take to Survive & Thrive As A Carrier?

Carriers need to be objective in evaluating their existing capabilities, identifying the areas that leave them exposed, setting priorities for their organization, and developing a new generation of solutions. Not surprisingly, it has to start by evaluating how well the organization understands and is equipped to act on the evolving needs and expectations of the customer. Then they need to assess if and how these may be better served through digital solutions.

The tough part will be aligning business strategy and funding to address those needs and to develop digital solutions that can drive growth and profitability.

Building human resources and the culture to thrive is requisite for companies that expect to thrive in the digital economy. Clearly, skills in data, analytics, and machine learning will be required. But beyond that, you will need to bring people from younger generations into the company. People who can relate to the new generation of buyers and their needs. People that are given positions of leadership to meet those needs.

Stepping up capabilities in risk management, particularly those associated with digital initiatives, regulatory compliance, data privacy, and cyber security, will also be required.

Continuous innovation: To stay competitive and meet changing customer needs, carriers must commit to continuous innovation, investing in new technologies and improving their digital capabilities over time.

Developing new digital solutions often requires collaboration with third-party vendors, so carriers must ensure they have the right partnerships in place to support their innovation efforts. They will need to develop and manage a digitally savvy partner ecosystem. No company can understand and address all of these needs on its own. You will need an extended team. One that includes third-party providers, brokers, and other industry players to support digital initiatives and deliver more comprehensive solutions, including value-added services.

Technically Speaking, What Will It Take To Thrive?

Delivering digitally competitive Life and Voluntary Benefits solutions will require a significant investment in technology. Those investments start with data integration across disparate systems and sources to gain a more comprehensive view of the customer, their risks, and their needs. Those include advanced analytics that leverage machine learning, artificial intelligence, and predictive modeling.

Developing next-gen technical architecture that is agile and scalable is critical as well. It has to enable the company to quickly adapt to changing customer needs and market trends and deal with real-time data. Those capabilities are now table stakes.

That architecture must enable carriers to integrate easily with a Digital Ecosystem of partners, including brokers, carriers, third-party providers, and value-added services providers. An Ecosystem that includes mobile devices that support physical and mental well-being.

Carriers will also need to leverage a new generation of Digitally Native Platforms. Platforms designed to support the needs of a Digital First Company. Platforms that support real-time data flows, self-service, automation, and decision-making. These will be essential in delivering a seamless customer and partner experience in an Omni channel environment.

Security and privacy are other key investment areas. Given the rise in digital solutions, products composed of multiple services, and increasing cybercrime, implementing robust security and privacy measures to protect customer data and build trust is a must.

What’s the Business Case for Acting Now?

Why is it critical now for life insurers to develop a new digital generation of life insurance solutions to address the needs and emerging risks of the new generations of buyers?

The new generations of buyers are voting with their dollars. They have different needs and expectations and are demanding a more digital customer experience. Digital solutions can create a more seamless and convenient customer experience, increasing customer satisfaction and loyalty.

Digitally savvy competitors are moving faster. Insurers that fail to innovate and develop digital solutions risk losing market share to more agile and innovative competitors.

The emergence of new risks, such as cyber threats, pandemics, and environmental risks, requires new digital tools and approaches for risk assessment and management.

In an increasingly chaotic economy and in a market where increasingly effective digital competitors, improving efficiency and profitability is a must. Digital solutions can improve efficiency, reduce operational costs, and increase profitability by automating manual processes and streamlining operations.

Competitors are using data and AI to rapidly improve and accelerate decision-making. The insurers with better access to data and analytics are outperforming their slower counterparts in just about every part of the customer journey and the insurance value chain.

Future-proofing the business – developing a new digital generation of life insurance solutions is critical to future-proof the business, as digital solutions are becoming increasingly important to stay competitive in the industry and meet customer expectations.

The message is clear. Life insurance and Voluntary Benefits executives need to act now to create a new generation of digital solutions in order to streamline processes, reduce costs, and improve customer experiences. Failure to do so risks losing market share and falling behind competitors.

Your thoughts and comments are appreciated.