Insurance 2.0: A Survivors Guide

Watching insurance CEOs grappling with InsurTechs, emerging technologies, and rapidly changing customer expectations a few years ago, was like watching a struggling new guitar student. That’s Changing! They started struggling to make fingers form uncomfortable new positions. Failing to coordinate right-hand and left-hand movements. Trying desperately to make their beginner’s voice and hands resemble something close to the song they were trying to play. Many got frustrated and put the guitar or digital innovation back in the case. More than a few persevered. They’ve moved past the first barre chords. Today they’re starting to find their digital groove, and what they’re going to do next will rock the industry.

The CEOs that hung in there are building and supporting teams that have the skills to understand and deliver digital generation solutions. They are developing a vision and strategy set in the digital future instead of the paper past. They are actively seeking and building successful partnerships with emerging technology firms and InsurTech startups. The basic chords needed to stand on the digital stage.

There are however CEOs for whom just getting up on stage and working through a cover set will never be enough. They are the ones who will take their companies and the industry to the next level. They’re building cultures and organizational structures designed to fill arenas with digitally engaged and supported customers by delivering breakthrough value to them. Value created by looking at insurance through entirely new lenses and developing business models and products designed to define the digital age of insurance. Those are the CEOs that will be recognized in the next several years as the digital rock stars of insurance’s digitally-connected future.

So what’s their setlist look like? What are the building blocks they will use to move their companies and the industry from a few basic digital chords to industry bending progressions and arrangements– Compositions that leave the rest of the industry playing in local bars while they stand on the world stage.

Optimizing Teams and Digital Lessons Learned

CEO’s who emerge as the digital stars of the insurance world will continually take stock of not only what has and hasn’t worked within their organizations, they will also look beyond insurance to understand those lessons from outside of their industry. They recognize that learning from others is as critical to innovation as learning from your own efforts.

Lessons Include

Future Proofing Investment in Digital Infrastructure

The insurance industry of the future is surrounded by a world of constant innovation and change. In order to compete and survive, it’s necessary to have a digital infrastructure that is able to support continuous innovation and change.That doesn’t mean just moving to a new core system environment. It means taking time to understand emerging technology, business, and architectural model trends and the requirements they will place on the business and your infrastructure and core systems. It’s important to select systems and architectures that are designed to continually evolve, that will support frictionless interoperability with external systems and data models. Future proofing also means evaluating potential acquisitions, not just for the lines of business or customer base they represent, but also for whether their core systems and architecture will be an anchor or a catalyst in helping you succeed in the digital future.

Reimagining Insurance from the Outside in

The best leaders are creating a vision from the outside in. They are starting with the customer and trying to understand their goals, challenges, and circumstances. Starting there gives them a better line of sight into where they can create incremental value for the customer. In a digital world that also means understanding how the user will be using technology to support their goals and lifestyle. With that as a base, they can then look at how emerging technology can be added to the mix to better support and enable the customer.

Harnessing the Power of Digital Ecosystems

The next step is to understand the digital ecosystems surrounding the insured and how the solutions, devices, and data within those are supporting the customer. Developing a map of those ecosystems and the value they create is the first step. Next, they can assess what role insurance can play in those ecosystems and how combined with the other solutions and data can be developed into powerful new insurance business models and products.

Born to Partner

In a digital world where interoperable ecosystems and solutions can be combined instantly to form new highly personalized solutions to meet real-time contextual needs, partnering is imperative. Excelling at partnering in a world of digital ecosystems requires the ability to partner instantly from a business and technology standpoint. Examples of this are the “there’s an app for that” world of Apple, and the Salesforce AppEchange. As an ecosystem and platform owner, they make it very easy for partners to develop and deploy solutions into their platform and make it even easier for customers to access those. There are no long drawn out contract negotiations or application integration cycles. It’s literally plug and play from a business and technical standpoint. This is where the next generation of ecosystem-based insurance solutions are headed. Without that kind of partnering capability, companies won’t survive.

Continually Reinvent

With the average life expectancy of large companies decreasing and the pace of innovation increasing, companies that survive will be the ones that never stop reinventing themselves. So like Jazz or country music today which are continually evolving and constantly and creatively being reinterpreted, the insurance industry must do the same.

Think about Apple. It went from selling personal computers, to completely redefining the music distribution business, to redefining the mobile phone industry. Think about Netflix that went from distributing CDs in vending machines to the online powerhouse it is today. Or, Amazon moving from an online bookseller to the world’s largest retailer.

These companies never stop seeing the world differently and reinventing how industries work. Insurance companies that expect to survive in a digital economy must do the same. The CEOs who guide their companies using the above formula will emerge as leaders that will play on the world’s stage. The rest will fall behind and can expect nothing more than to be playing in the local bar.

Come listen to topics like this and others from innovative industry leaders at InsurTech FUSION Summit on June 18 -19 in San Francisco.

Stay on top of all the latest InsurTech news and trends on the SVIA blog!

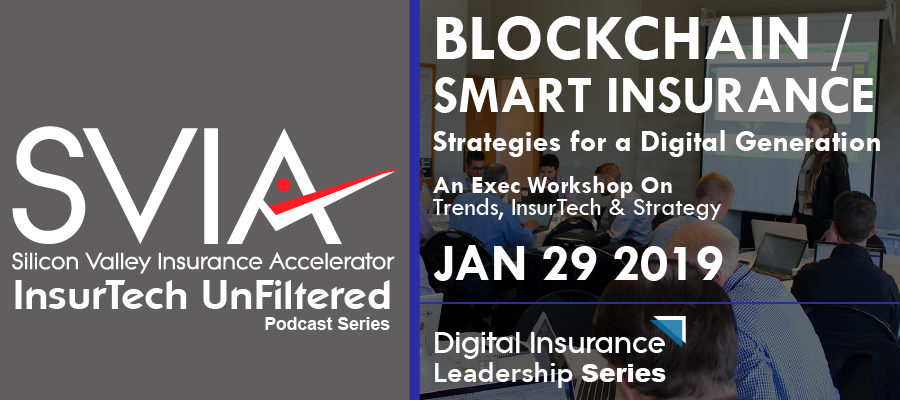

Introduces emerging Blockchain enabled products & business models. Includes discussions on strategic implications and expected timeline for adoption. ~ Speaking: Natalie Wood – SVIA | Brian Casey – Locke Lord | Truman Esmond – AAIS | Robert Barkovich – Health Linkages