For the most part, insurance carriers haven’t really viewed the claims process in a positive light, as it is complex (especially with a multiparty property and casualty claim), tedious (lots of data and fact gathering), and filled with suspicion (carriers thinking that policyholders could be trying to defraud them and policyholders thinking that carriers could be trying to pay less than what they are entitled to). Because of these factors, carriers have often viewed the claims process as more of a necessary evil than an opportunity to deliver a better experience to policyholders.

Well, it’s safe to say that carriers’ mindset on the claims process has shifted in recent years as a wide range of InsurTech vendors has emerged to enable a better claims experience. These vendors offer solutions that can minimize the tedium, lessen the complexity, and lower suspicion for both parties, all of which ultimately contribute to a better claims process for policyholders (and carriers as well).

Carriers can access InsurTech solutions that allow automated first notice of loss intakes, deploy drones to conduct property inspections, empower claimants to upload photos or videos of damaged property, use telematics to determine exactly the extent of damage a car or home has incurred, or leverage artificial intelligence to detect fraud. Many of these solutions are focused on delivering an efficient process and include chatbots or flow management software.

Beyond process is the ever-increasing number of data sources that carriers can use to arrive at a more accurate claims decision more quickly than ever. These data sources are not limited to standard data, such as property characteristics or vital statistics. These sources can include data such as weather data, social media data, and geolocational data—all of which can be used to more fully inform carriers about the people behind the claims, conditions at the time a loss was incurred, or the true value of the contents lost. While data on its own is nice, analytics that can draw out meaningful insights about a claim is divine. This is where the evolution of digital claims is heading.

But the mere existence of these capabilities does not mean that carriers are embracing them widely. It would be fair to say that a majority of insurance carriers have only begun to explore using these InsurTech solutions, and a majority of those carriers that have gone beyond exploration have only embedded a limited number of these techniques into their claims processes. Indeed, there is a long way to go for carriers to embrace a holistic solution that makes the claims process less tedious, less complex, and more transparent.

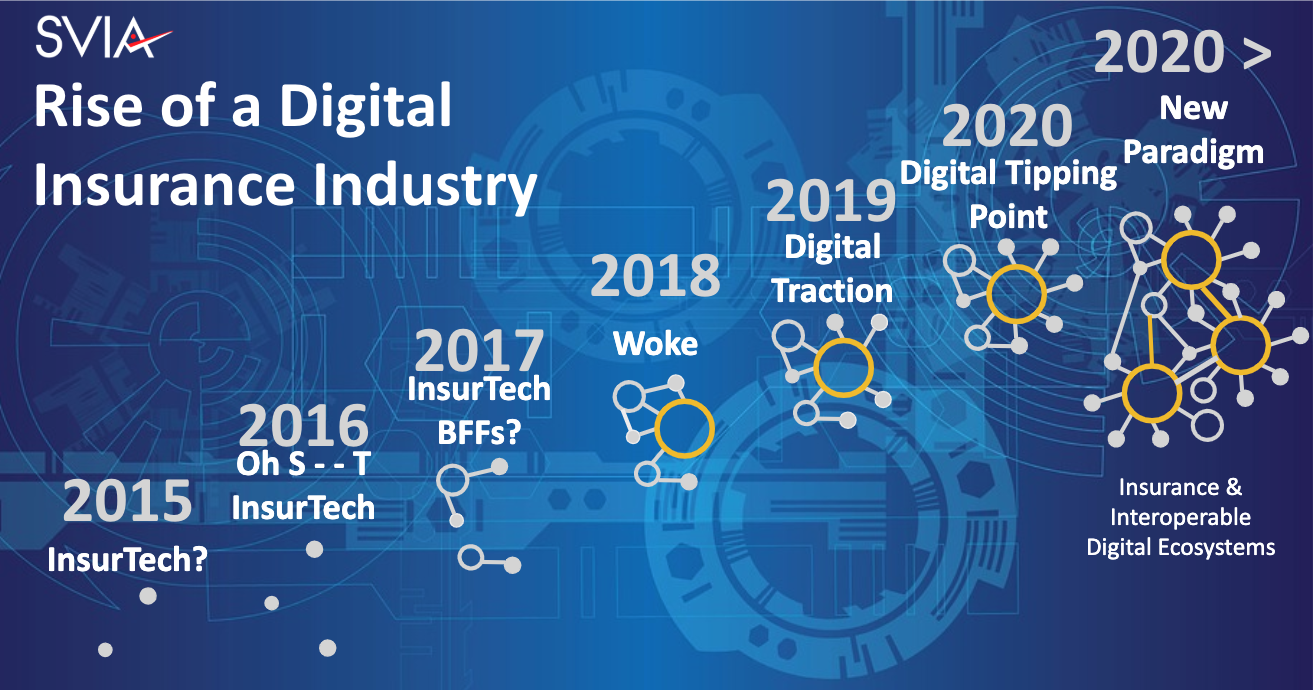

The Silicon Valley Insurance Accelerator (SVIA) will host its annual InsurTech Fusion Summit: Rise of a Digital Insurance Industry on June 18 and 19, 2019, in San Francisco. Digital claims will be a main topic of conversation with many new data elements and technologies being discussed. Don’t miss the opportunity to learn how to take the next step in building a better claims experience through digital tools.

Register now at www.insurtechfusion.com and get 15% off of your registration using the code JAYS15. Aite Group and SVIA look forward to seeing you there and helping you take the next step in your digital transformation journey.