What will it take to Survive & Thrive in the New Insurance Paradigm: Insights from our June Summit

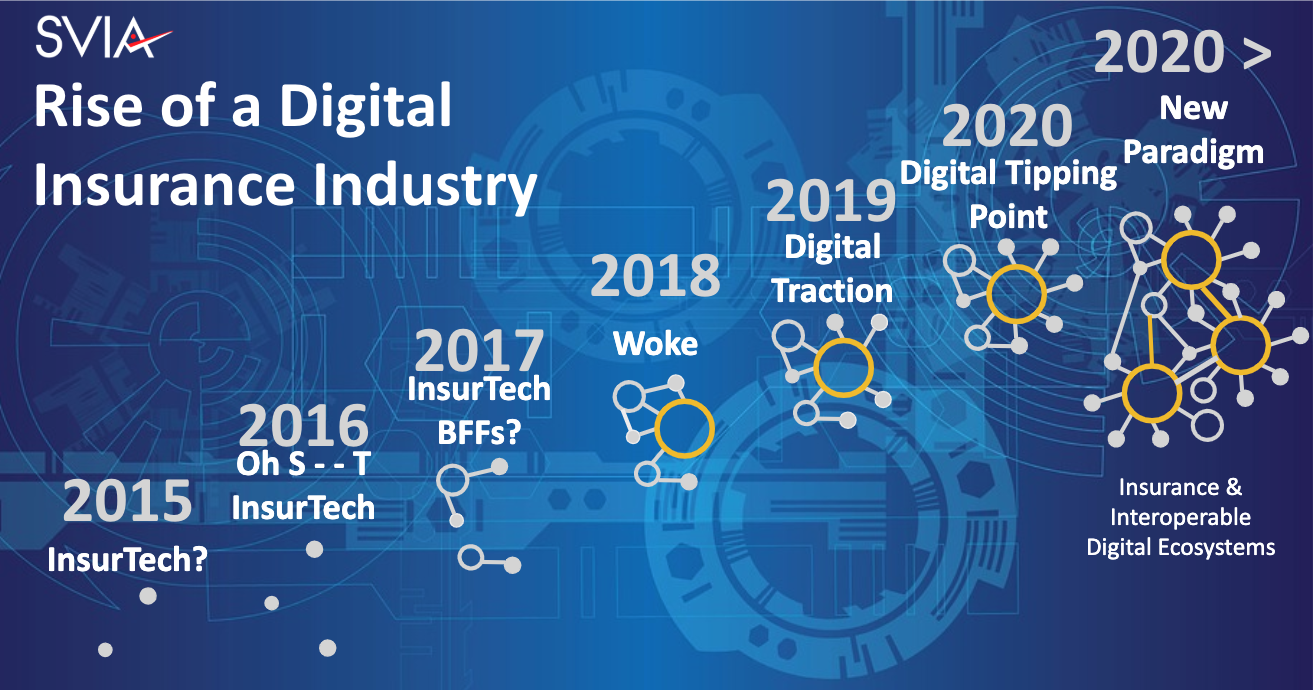

A new paradigm composed of digital ecosystem enabled solutions and business models is fast approaching. That new paradigm will be composed of Insurance solutions that are Faster, Hyper-Connected, and Incredibly Intelligent. Those solutions will be Interactive components of the digital ecosystems surrounding us. They will work interactively to safeguard our families, businesses, communities, and nations. And, they will proactively identify emerging risks and decisions that optimize outcomes transparent and actionable at and between those levels,

Insurers need to be Fearless, Flexible, have fun, and learn to fail fast if they expect to survive. Leading brokers are on the hunt for carriers that can help them deliver these next-generation customer-centric solutions.

Customer and Industry Insights & Survival Requirements for 2020 & Beyond.

Customers small and large want and are willing to exchange data for personalized solutions that include services that help them better achieve their goals. Meeting the needs and expectations of Millennials will define who insurances new leaders will be. They are ready to buy from big tech.

CRM will drive customer engagement and personalization. Data/analytic-driven Cloud-based solutions will become the norm. Leaders are racing to develop ecosystem strategies and partnerships.

Customer Engagement and Empowerment

Next-gen insurance solutions aren’t just being deployed on mobile devices they are being designed to take advantage of the sensors and location awareness of those devices. They are also being designed to enjoin and empower customers and the communities surrounding them to better achieve life and business outcomes and goals. It will take digitally native and digital savvy core systems to compete with the next generation of customer engagement and solutions.

Ecosystems and Platforms

Major players domestically and abroad are developing cloud-based ecosystems of insurance solutions, services, and partners. These ecosystems accelerate and reduce the cost of innovation and solution development. Amazon, Chinese Giant Ping An, and several others are heralds of what is coming. They are setting the stage for the competitive landscape to come. Though Ecosystems take many forms, it is their interoperability that makes them so powerful. The future will see ecosystems for solution development, customer engagement and even co-creation solutions and frameworks that enable insureds to work with brokers and carriers to develop custom solutions on the fly. The carriers that are bold enough to bring to market business models that thrive in an ecosystem environment will be the ones that survive.

Next Gen Business Models

Life, Annuities/Wealth and Wellness: Next gen models will engage customers and the stakeholders in their life journey through gamification to help them achieve the outcomes they desire. These blended solutions will leverage data and behavioral science as well as 3rd party services and solutions from the ecosystems surrounding insureds.

Personal Lines: Business models and insurance solutions that help customers address and thrive within the megatrends impacting our world including intelligent devices and autonomous vehicles. These solutions will be flexible, connected, and context-aware. They will be highly personalized and will provide individuals and their families an integrated, proactively protective set of solutions that help them prevent and recover from risks.

Commercial Lines: Simple, Connected, Broker Supported and Data Driven. The revolution is coming to Commercial Insurance. Competing successfully will require next-gen integrated approaches to customer engagement and support and will use data and analytics to anticipate needs and make recommendations. Like personal lines, small commercial will need to address megatrends and must deliver blended solutions. Distribution will use data and AI to align the insured with the right broker and carrier partners.

Core Systems, Underwriting & Claims

Core Systems: The next generation of core systems requires a new way of thinking. They must move carriers closer to the customer. They will enable carriers to interoperate with solutions for the digital ecosystems surrounding insureds. Instead of Digital on the outside, they must be digital to the core. Core systems must help carriers jumpstart innovation and enable them to connect in realtime to data and solutions that inform, inspire and enable the end customer and the broker. Carriers will still need to digitally wrap existing core systems to keep pace with the innovation in the market.

Underwriting: Digital Underwriting is coming quickly. It isn’t an easy transition, but it is extremely necessary. New products and business models, as well as customer expectations, require a new generation of underwriting. One that can process information in real-time. Digital Underwriting opens the door wide for innovations in customer engagement, and product and business models. New data sources and powerful AI are key requirements for this new generation. They must be able to blend and analyze multiple data sources to achieve the speed and accuracy required to compete in a digital insurance paradigm.

Claims: The same requirements and opportunities exist for claims as underwriting. They are key to customer engagement and retention. New services and data enable insurers to capture FNOL instantly whether from sensors or from leveraging the power of mobile devices, including image capture and video conferencing.

Climate Change and Extreme Weather

The impact of Climate Change and the extreme weather events it generates is increasing dramatically in frequency and strength. The results are catastrophic to not only insureds but insurers. As an industry and a global community, we need to come together to work not just on hardening our properties and communities against these events, we also need to work collaboratively to proactively reduce the factors that are driving climate change. SVIA and SVIA Members, the Insurance Information Institute, NAIC, and the state of California are working collaboratively to define programs and to identify innovators that can help the industry more effectively address this growing threat.

Industry Collaboration Required

The requirements, changes, and opportunities being driven by customer expectations and global megatrends will have a huge impact on the insurance industry. Big tech and global giants in the industry are developing ecosystem and platform plays. Plays that will create a powerful competitive advantage for those in the inner circle. The only way to compete against those is to work collaboratively to develop the insight, the infrastructure and solution and business models frameworks the rest of the industry can thrive within. SVIA has launched three innovation working groups to help bring those capabilities to life. Working groups include Extreme Weather, Life, Wealth, and Wellness, and Small Commercial. Proposed initiatives include creating visions for ecosystem enabled markets in each of those areas, developing profiles of the solutions within the ecosystems surrounding insureds, and developing prototypes of the customer journey, solutions, and infrastructure required to enable them. Additionally, we will be developing data and data models to support those.

InsurTech and Beyond: Investment Strategies for a Digital Insurance Paradigm

Investors are looking for opportunities that align with the changing nature of the world and the insurance industry. They are focused far less on shiny new technologies and far more on solutions that will drive customer value, market share, revenue, and profits. They see opportunity unfolding not only for full stack insurance plays, but also solutions that generate high impact improvements across the insurance value chain. They are looking for solutions that will create and sustain value within a world of digital ecosystems and solutions that address emerging needs created by the global megatrends changing our world.