What Does It Take To Be Transformative?

The future of insurance is well and truly here: the only way insurance carriers will be

able to survive and thrive is by utilizing big data, including new and emerging data

sources.

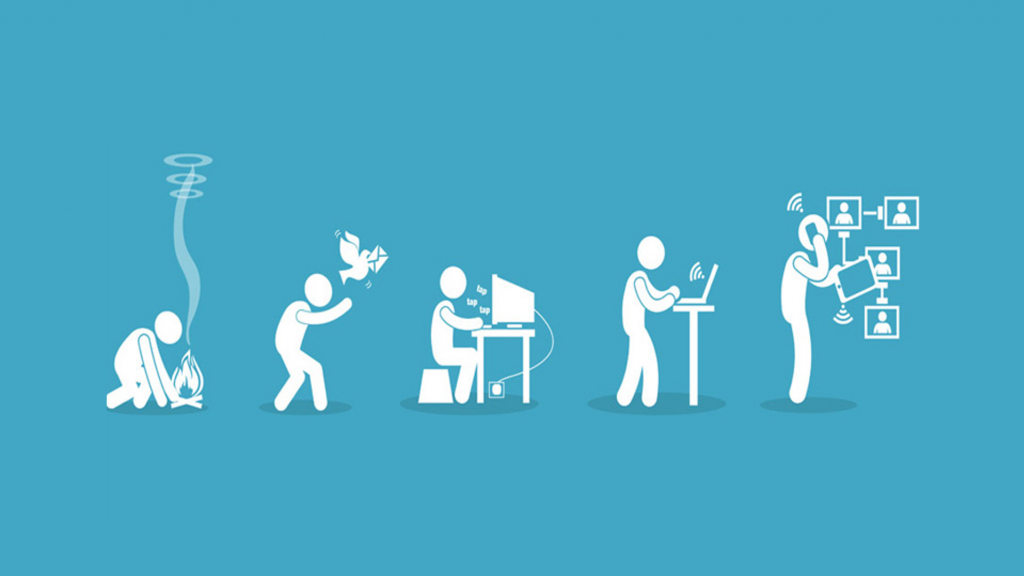

In an interview with Mad Money’s Jim Cramer on CNBC, Chubb Ltd.’s Chairman

and CEO Evan Greenberg commented: “We spend a billion dollars a year on

technology. We’re in a world that’s going from analog to digital…if you remain analog,

you’re history.”

Greenberg wasn’t just describing digitizing an industry that has historically adopted

technology at glacial speeds, but how harnessing big data can help insurers actively

predict and prevent loss, rather than only deal with the financial aftermath.

“Loss costs rise every year by four to six percent,” explained Greenberg. “There is always

inflation on liability, property, repairs, labor, and so on.”

This is where technology, especially AI and machine learning becomes an advantage,

not just the latest industry buzzword. Traditionally, insurance carriers use legacy data

sources across all lines of business and some, like Chubb, are using new and

alternative data sources to alleviate systemic problems. These alternative data sources

include social media and publicly available online data and have been proven to

mitigate loss cost, among many other benefits.

In the interview, Greenberg specifically mentions claims and underwriting as areas to

better serve their clients. For example, the existing process for pricing, quoting, and

underwriting small and medium-sized businesses is predominantly manual, time-

consuming, expensive, and not ideal for the carrier or consumer.

“Right now, if you’re a small business, to underwrite you we ask you about 30

questions. For Chubb, over the next 18 months, that’ll come down to about seven

questions, because we can just scrape the answers from data that is publicly available.

[We] don’t need to bother you with that,” he told Cramer.

By using this type of new and emerging data, carriers can complete the picture of new

business and streamline their intake process by prefilling profile data and standard

eligibility questions with validated data. But why would a carrier only evaluate the

business once during the policy’s lifetime?

“Until now, carriers have looked at data at a single point in time, at the underwriting

stage or the first notice of loss or injury,” says Max Drucker, CEO, and Co-founder of

Carpe Data. “But now we live in a world where data can be accessed continuously, it’s

fluid—data is a stream. So we can see when business is offering a new service, or

when an apartment building added a pool as it happens, rather than waiting for the next,

undetermined point of time when a carrier may check a database.”

An insurer monitoring emerging data sources can see changes as they occur, giving

them the potential to react sooner to both risks and opportunities, like monitoring

business performance and reacting to material changes that either create new risk or

change eligibility.

Other ways that a carrier can see immediate benefits include being able to act quickly

on inaccurate or missed data that would have been too difficult to discover without

consistent data monitoring, or easing the intake of new business with better pre-fill and

eligibility checks. For instance, a beauty salon adding waxing services, or a cafe that

upgraded their alcohol license from beer and wine to add liquor are scenarios that

create potential upsell opportunities and valid touchpoints for agents with their clients.

In short, a matched business in the hands of an agent together with a detailed picture of

risk is a very compelling sales scenario.

“In the small space of time that these alternative data sources have been available to

carriers, they can now be at the forefront of this evolution by having the ability to

continuously monitor their policies with real-time data, across their entire book,” explains

Drucker.

Being able to underwrite with more than a static picture results in a true return on

investment for carriers, with prevented claims, opportunities to upsell, reduced premium

leakage, and overall processing efficiency.

Get all of your insurtech news and insights on the SVIA Blog.

Blockchain has captured the imagination of the insurance industry. In the past several years, insurance has gone from ignoring blockchain to leading other industries in terms of investment. Individual insurers, startups, and alliances between major insurers, technology vendors and major commercial customers have produced amazing visions and proofs of concept. For all of that work, only a small number of commercially deployed insurance solutions have emerged. So the questions become, with all of the challenges and opportunities insurance faces and all of the other promising technologies at its disposal, is blockchain smart for insurance and if so, where should blockchain be on the priority list?

Insurers’ priorities need to enable them to sustain an advantage in a digitally-competitive market. That market will be empowered by digital ecosystems and platforms. A market-driven and shaped by the same economic and technical forces that created Apple’s App Store, Google, Amazon, Facebook, Linkedin, Salesforce, and Ping An the Chinese giant and the ecosystems it’s creating. These digital ecosystems deliver customer value by making it easy for customers to connect to the people and solutions that best help them achieve their goals. It creates value for ecosystem providers by making it easy for them to connect to customers and partners.

The ecosystems and platforms forming in insurance will give birth to hyper-connected customer-centric solutions, services, and digital business models that join and blur the boundaries between Industries and lines of business in insurance. These next-generation solutions will include data-driven On-Demand and Connected solutions that are tied into the sensors, buildings, equipment, social media activity, and data surrounding that are being generated by insureds. Highly personalized interoperable real-time solutions that help guide insureds’ behavior and decision making to more effectively achieve life and business goals and outcomes.

These ecosystems coupled with emerging technology enable those who take advantage of them to connect contextually to insureds based on what they’re doing and what their needs are in real time. With real-time profile information about the insured collected from those ecosystems, innovative leaders can deliver highly personalized experiences and insurance solutions to the customer throughout their lifecycle and journey.

New Digital Generation Enterprise Architectures and Core Systems are coming to the market. These are solutions designed for the digital industry. They will leverage the cloud and microservices making connections to the digital ecosystems, platforms, data, and services surrounding the customer far easier. They will enable companies to bring smarter, more powerful, highly personalized insurance offerings and core processes to market faster and less expensively.

The highest priority for insurers is creating the digital vision, culture, and infrastructure required to compete in the digital industry. One-off products or solutions won’t be sufficient. There are a number of resources, powerful technologies, and new business models that can help them to do this. The question companies exploring blockchain have to ask is where does blockchain help them address these requirements more effectively than other options.

Blockchain promises to lower operating costs by automating processes, more effectively detecting fraud and by being a more effective and secure transport mechanism for data. Its cryptography, immutable ledger, and consensus validation are designed to Increase trust between parties. It also vows to Improve customer experience by using smart contracts to eliminate paper and accelerate processes, in addition to opening the door to new business models.

The range of insurance POCs is remarkable. They provide tantalizing examples of what blockchain might enable. Companies like Civic are developing a blockchain solution for transferable identity. A number of companies are following the example of Evident using blockchain to manage proof of insurance.

Collaboration in the Life, Health, and Medical space is focused on managing patient records and creating life and health insurance products. More than a few startups are developing peer-to-peer plays in the personal lines such as Umbrella and Addenda out of Dubai. State Farm is evaluating a solution for subrogation claims, while Kasko is developing an ICO-based Marketplace with a complete auto insurance offering. XL Catlin, Zurich, Allianz, and Swiss Re are experimenting with CAT Swap transactions and settlements. Still, others are evaluating ridesharing insurance, trading life insurance policies and securitizing CAT policies for property insurance.

In addition to these POCs, several blockchain solutions are in commercial operation. Examples of supply chain focused solutions include Everledger which supports tracking the providence of diamonds and Maersk the shipping Giant who is working with a number of companies to establish a maritime shipping and trade platform. Solidum Partners has enabled the securitization of reinsurance contracts. And, there are a number of companies that have launched Travel Insurance Solutions.

There are some clear divisions between how InsurTech Startups and Incumbent insurers are planning to use blockchain. Insurtechs for the most part are focusing on using the technology to create new products and services and creating new markets using distributed autonomous organizations. Incumbent insurers are focused on reducing the friction and cost and mistrust of existing processes.

The most exciting thing about these solutions is the industry’s willingness to step outside of its current paradigm. Blockchain enables the industry to look at inherent pain points in insurance business models and solutions with a fresh set of eyes. Additionally Blockchain has opened the door to collaborative innovation and development of solutions through groups like B3i, R3 / Corda, RiskBlock Alliance, and Open IDL. This kind of open collaboration will be critical to companies that want to sustain a leadership role in a Digital Industry.

As exciting as the work going on with Blockchain is, the technology has inherent weaknesses and challenges. Those include scalability, speed, complexity, compute and energy requirements and interoperability. Issues that arise from the foundational architecture of blockchain and how it stores data and transactions. In addition to these challenges, there is much work to be done in terms of laws and regulations surrounding blockchain solutions their ability to be audited.

Ease of use, speed to market, flexibility, scale, real-time processes involving huge amounts of data and transactions and interoperability are critical to the insurance products, processes, solutions and systems that will be needed to compete in a digital industry. To date, these are all things Blockchain is struggling to overcome.

There have been a number of surveys conducted throughout insurance and other Industries to determine when people believe blockchain and distributed ledger technology will become a core part of the technology platform powering industries. On average respondents place that somewhere between five to seven years out.

Let’s start with some baseline assumptions. First, large technology companies and startups are working around the world and literally around the clock to overcome blockchain’s limitations. Where true incremental value can be created at an industry level we will see commercially available solutions developed. We will also see “Blockchain as a Platform” solutions developed that make it far easier for others to build custom solutions. We will also interoperability addressed as Blockchain solutions gain traction in the market.

Every company should start with an overall vision for what a digital insurance industry will look like and what it takes to compete within it. Next, they should look at where they currently are in terms of their digital transformation. Where do they have critical gaps in terms of vision, culture, people, processes, and systems? Once they have, they need to prioritize those and evaluate what the fastest most effective paths are for them to ensure that their customer engagement, products and services, processes, and infrastructure will be competitive in a digital market. Lastly, they need to assess where blockchain’s current capabilities with its limitations are better suited to address their most pressing priorities than any other solution.

Large companies that have a broad and well-funded innovation portfolio can afford to invest in a broad range of blockchain initiatives. Those include internal projects, associations, and investments in blockchain startups that are addressing blockchains limitations as part of the solution they are developing.

Midsize companies should participate in or develop collaborative Blockchain associations that are addressing the strategic priorities they have defined. If they have the bandwidth and budget they should also undertake lightweight POCs that align with their priorities internally with startups and technology companies.

Smaller companies should keep abreast of emerging packaged blockchain solutions that align with their internal priorities. When those solutions demonstrate clear proof of viability and incremental value, they should trial them.

Every company should go through the thought experiment of looking at internal priorities and asking how blockchain’s capabilities might help them create unique powerfully effective solutions. It’s a way to think outside of the box. Even if blockchain isn’t the solution, going through the process can yield new innovative ways to think about the issue and solve the problem. That’s called innovation.

For more blockchain insights, visit our podcast page to hear what some of the top innovators are saying on the subject.

Blockchain startups deliver 3 minute pitches for investments and partnerships. ~ Speaking: Marcus Schmalbach – RYSKEX GmbH | Muntaz Kaleem – BlocKardia | Jonathan Chou – Bee Token | Valentin Bercovici – Pencil Data | John Fohr – TrustLayer | Ravi Kumar – Statwig

Hands-on exec workshop that guides participants through integrating Blockchain and related ecosystems into the company’s overall Digital Insurance, Product & Partnering Strategy. ~ Speaking: Derek Lovrenich – insurEco System | Phil Duncan – insurEco System

Introduces the platforms & consortiums enabling & accelerating industry adoption of Blockchain. Includes discussions on strategic implications & recommended assessment / engagement strategies. ~ Speaking: Christopher Frankland – ReSource Pro | Marcus Schmalbach – RYSKEX GmbH | Irv Latta – Symetra Financial Insurance | Robin Westcott – AAIS

Discusses the legal & regulatory opportunities & challenges for Blockchain in insurance. Includes discussions on strategic implications & timeline. ~ Speaking: Natalie Wood – SVIA | Courtney York – Akin Gump | Keith Schraad – Arizona Department of Insurance | Andy Beal – NAIC