Digital innovation is no longer just a nice to have; it’s a must-have. It’s no longer just about reducing costs or improving margins; COVID-19 has shown that it’s now an imperative addition to risk management processes and business continuity planning (BCP) as well.

The Good and Not So Good

To their credit, many insurers dealt very well with shifting workforces to working from home. But there are other gaps that have inevitably become apparent – for example, poor digital customer experience, overwhelmed call centres, adviser inefficiency (especially when in-person sales are impossible), systems not based in the cloud, manual claims processes.

Digital Wins Over Face to Face & Call Centres in a Pandemic

One big facet of BCP planning is maintaining sales, and with face-to-face advice impossible for now and very difficult for the foreseeable future, insurers need to have a slick digital presence. This doesn’t just include online quoting for direct general insurers, but also applies to insurers who distribute via adviser networks. A big wake up call for insurers courtesy of COVID-19 has also been how heavily reliant on call centres and in-person sales they are.

Many insurers’ BCP plans spread call centre locations across multiple countries with the intention of spreading the risk. However, in the case of a global pandemic, this is insufficient. For advisers who didn’t have any digital means of dealing with clients beyond video conferencing, the volume of manual work to screen and convert a lead has also become apparent.

By properly digitising and fully automating insurance policy quotes and sales, or even just adviser/broker referrals, insurers can:

- protect themselves from the immense strain on human staff when workforce numbers are low and enquiries high

- reduce the time required for advisers to screen and convert leads

- speed up assistance for customers in their time of need. Insurers who do this will not just benefit from gaining competitive advantage but will be ready – not if – but when this sort of crisis happens again.

InsurTechs and Bite-sized Innovation

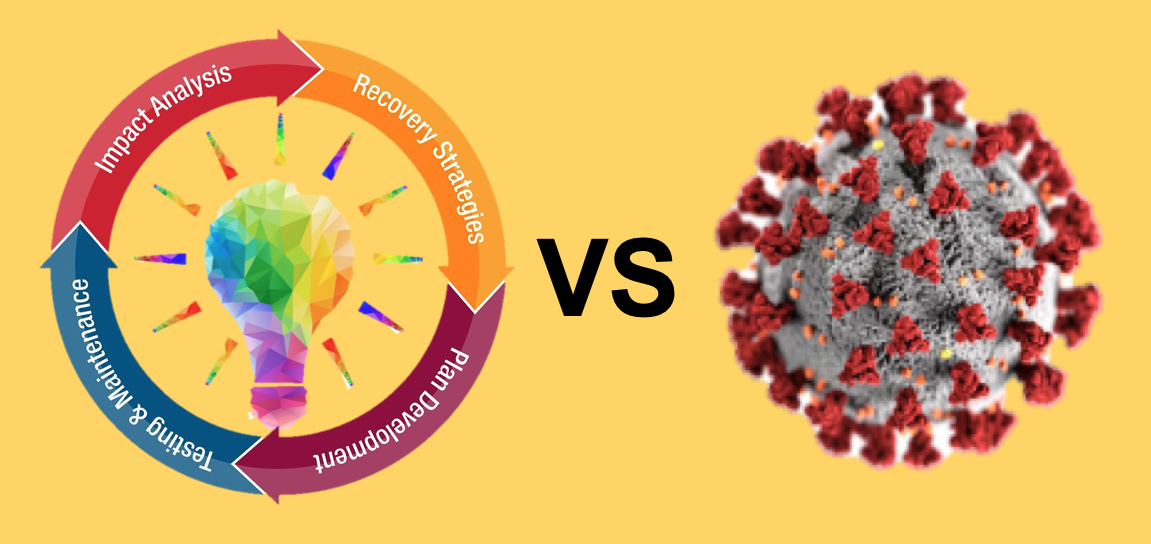

Once the dust settles, it may also become evident that innovation models for insurers are typically long and slow including sometimes overly complex procurement processes, huge internal upheaval and high costs. The need to move quickly is clear in a crisis, and partnering with insurtechs is a great way to do that. Insurers can start with bite sized innovation projects in a low cost, low risk, and secure way and test out more streamlined procurement processes on these less risky and less disruptive projects.

This is an opportunity for insurers to become more agile and efficient – to test, learn, iterate – which will, in turn, speed up future innovation projects and improve their future ROI. The need to innovate and to do so quickly is clear – not just to gain competitive advantage but to plan for the future, and it’s a great time to partner with Insurtechs who are set up to deliver innovation projects with agility.

The time is now.

Michael Lovegrove is the CEO of New Zealand headquartered Insurtech company, JRNY which provides the insurance industry a customer journey platform