Innovation & Agility = Insurer Survival. COVID rocked our world. Normal family, community, and business practices turned upside down. Insurance operations that relied on paper and in-person interactions obsolete. Surviving requires innovation and agility. Without an enabling platform, it’s impossible. That’s why every insurer needs to build an innovation scorecard.

Gaining an Outside-In Perspective

Let’s’ take a step outside of insurance for a few minutes to gain some outside-in perspective. In February of this year, US automaker, Tesla, recorded a Market valuation of $160B, making it the second-most valuable automaker, behind Toyota. Its market value is now greater than GM, Ford and Fiat Chrysler combined. GM has electric vehicles. Ford has electric vehicles. Fiat Chrysler has plans for hybrids and all-electric cars and Jeeps. What makes Tesla any different than these automotive giants? How did the startup catch and surpass some of the world’s largest auto manufacturers?

Innovation as a Core Business Principle

Tesla subscribed to the notion that innovation provides value. Innovation is no longer thought of as the territory allowed for creative business outliers focused on disruption. And it isn’t a simple concept that is only applied to operational-tactical initiatives. It is a core business principle that companies must apply in broad strokes in order to remain relevant and competitive, something AM Best focused on in their Innovation Rating criteria which we discussed in our report, Future of Insurance: Optimization, Growth, and Innovation.

More specifically, however, Tesla wasn’t just innovating a process that had already been developed in the past. Tesla was born within a framework of innovation that had thrown out existing rules and assumptions. It was created with a foundation that would allow for innovation. Tesla’s founder, Elon Musk, applied first principles thinking, which is, “starting free from any pre-existing ideas, yet grounding conceptual frameworks with core fundamental basics.”

Holistic Vision – Nothing Sacred

Every aspect of Tesla engineering and production was reconsidered. What is necessary in a car? What parts can be left out if there is no combustion engine? How can automation be used for everything from welding to painting to purchasing? How can software be used to improve automotive performance year to year? What would the user experience look like if charging stations were plentiful and widely distributed? Instead of retrofitting traditional vehicular engineering with electric power plants, Tesla started with the notion that nothing was sacred.

Traditional insurers are now finding themselves with the need to provide digital experiences and innovative products, while they are watching existing insurers and startups gaining ground and surpassing them because they tossed out some of insurance’s traditional rules and chose to build a foundation in innovation from scratch. Insurers are asking themselves tough questions. What is necessary for an insurance product? How can software be used to improve product performance? What would the user experience look like if channels were widely distributed and omnichannel presence was digitally-enhanced?

This has caused an interesting reaction among insurers, many of whom are adopting a hybrid, two-speed approach to innovation — keeping the established business engines running with new modifications while trying to simultaneously get the all-electric powerplants out of the lab and onto the road.

The State of Core System Transformation

All of this will make a fascinating case study someday. Today, however, is the day to take a snapshot. In Majesco’s latest thought-leadership report, Insurance Digital Transformation: A New Era of Core Systems, Next-Gen Technologies, and Ecosystems, we take an in-depth look at the state of core system transformation by the numbers. What are the specific legacy hurdles that insurers are dealing with? If insurers are running multiple systems, how many are platform systems, and how many are non-platform systems?

Majesco has defined these systems as follows:

- Platform: Cloud-enabled, API and SaaS-based solutions or next-gen that are cloud-native, API, and microservices solutions.

- Non-Platform: Old monolithic legacy and modern on-premise solutions.

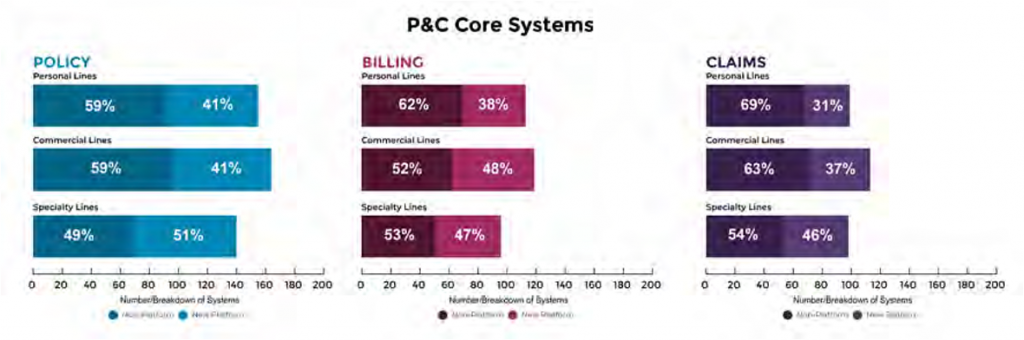

The Current State of P&C Core Systems: Platform vs. Non-PlatformGoing deeper into Majesco’s Strategic Priorities research, we found that there are a significant number of Non- Platform solutions still being used by insurers. These are the systems that are hindering agility, speed and innovation. Today’s systems need to foster innovation by supporting new business models, new products, digital customer experiences. They need to rapidly adapt to market shifts like those we are experiencing today. They must leverage ecosystems and allow the business to move from vision to market in days or weeks. Just how pervasive are the non-platform systems?

The research showed that overwhelmingly, with a few exceptions such as specialty insurance, P&C insurers are operating with Non-Platform solutions at nearly 60%, as represented in Figure 1. In particular, claims systems are the highest representation for Non-Platforms, at nearly 70%.

Drilling down further, we find that about 50-60% have at least one non-platform policy solution. However, the other 40-50% have either 2-5 or over 6 non-platform policy systems, representing a fairly significant legacy challenge. In contrast, those with one platform policy solution stand at 50-86%. Personal lines is the outlier, with 50% of personal lines insurers using modern cloud-based systems, and 70% using next-gen SaaS-based solutions. This places them at a significant advantage to adapt, innovate, and accelerate growth.

The trend between non-platform and platform solutions continues for billing and claims systems, with a significant percentage of insurers operating on non-platform solutions and limiting their ability to support innovative new products and services and curtailing any opportunities to leverage next gen technologies.

Agility, Speed, and Innovation Preparation on the Rise

What are insurers really missing out on if they aren’t preparing their foundational systems for agility, speed, and innovation? There are hundreds of new capabilities, API-enhanced relationships, and third-party technologies that can open wide the doors of growth and innovation for insurers.

In just one example, we see the rapid growth of voice assistants like Alexa in the home and workplace. Clearly, these could operate as both sales channels and service channels for billing and payment, yet many P&C insurers would be hard-pressed to take advantage of the opportunities. These capabilities would require platform-based solutions to leverage next-gen technologies. They require insurers to toss out some of the rules that they commonly adhere to and establish a new mindset that erases pre-existing ideas in favor of a fresh start.

Fortunately, there is an increased level of activity in the P&C core system buying cycle as noted

by SMA in their May 2019 report, P&C Core Systems Purchasing Trends: Foundational Technology to Fuel the Transformation Journey. Starting with their report in 2018, they noted that new core systems purchases were up 13% during the previous year, after a decrease over several years, but they continued to rise, according to the 2019 report with a gain of 11%.

Most encouragingly, cloud implementations reached the highest level ever with 75% of new core systems being deployed to the cloud. You can have a cloud solution without having a true platform solution, but you can’t have a platform solution without cloud. It is essential. P&C carriers opting for cloud core systems are cognizant of the fact that platform systems are the proper foundation for enterprise innovation.

Current State of L&A and Group Core Systems: Platform vs. Non-Platform

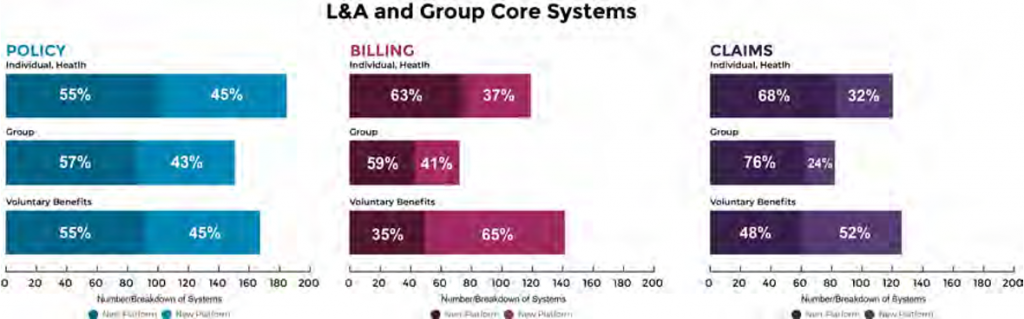

Overwhelmingly, L&A and Group are operating with Non-Platform solutions at 50-75%, as represented in Figure 3. Voluntary benefits carriers represent the strongest move to platform-based solutions. This is not surprising given the significant market interest and growth in voluntary benefits due to changing employee demographics, more job movement, the rise of Gig employees, and the desire for innovative new benefits and portability, as we have described in our SMB research and Future Trends reports.

The emergence of Greenfield and InsurTech startups like Haven Life or Ladder Life are examples of the growing focus by life insurers to stand up a new policy system to introduce new life products that leverage new data sources, AI and machine learning and technologies to rapidly underwrite and issue within minutes, rather than weeks or months …with most being on platform solutions

In drilling down deeper, about 25-60% have one non-platform policy solution, much lower than P&C. A staggering 40-75% have either 2-5 or over 6 non-platform policy systems, representing a significant legacy challenge. In contrast, those with one platform policy solution stand at 30-60%, with group lines being the outlier at 60% with a next-gen SaaS-based system, likely in support of the ACA healthcare act. This puts them at a significant advantage to adapt, innovate, and accelerate growth.

The increased interest in and demand for voluntary benefits, including vision and dental, has accelerated a focus on claims solutions, reflected in the growing numbers of platform-based solutions. Similarly, those who carry individual or voluntary benefits, long-term care and disability benefits also accelerated their focus on platform claims solutions. They are setting the stage for flexible, scalable, and innovative growth by making the system foundation fit the future.

Overall, across policy, billing, and claims there is still a significant percentage of L&A insurers on non-platform solutions, particularly for group and individual systems. With these non-platform solutions, it is difficult and costly to bring forward innovative new products and services and leverage next gen technologies that can help drive operational effectiveness and growth.

With Platform Systems, 1 is a Magic Number

The good news is that with L&A and Group insurers being behind P&C in legacy replacement, they have a unique opportunity to leapfrog from old legacy non-platform solutions to platform solutions, unlike many P&C insurers, who will have made their first, intermediate step to a modern on-premise solutions. Whether it is bringing new products to market, improving underwriting, or creating straight-through processing and new customer experiences, these can all lead to a focus on innovating the business in new ways by using new technologies.

No matter how many legacy or non-platform core systems exist within an insurer’s environment, it only takes one platform system to create a new foundation for innovation. It is the right first step into future of insurance. Finding a pre-built platform solution and accompanying ecosystem, such as Majesco L&A and Group Core Suite, Majesco P&C Core Suite, Majesco LifePlus Solutions, and Majesco Digital1st Insurance® is the perfect example of how an insurer can quickly and easily bring together cloud, digital, APIs, microservices, AI and machine learning and ecosystems and still remain linked to their robust policy admin capabilities.

Analyzing the Innovation Report Card

We began with the idea that innovation isn’t tactical. It is far-reaching and requires a new beginning — a ground-level innovation platform that keeps the core principles of insurance without the fear of losing traditional practices. We then uncovered the reality of the industry; most insurers, P&C and L&A included, are still grappling with non-platform systems that just won’t allow for innovation.

But what happens when innovation becomes an industry-recognized measurement — a public criteria to be used as a predictor of growth? In two of our upcoming blogs, we’ll look at A.M. Best’s new report on insurance innovation and discuss how it relates to platform solutions, aligning with Majesco’s knowing-planning-doing framework. Will this kind of industry scrutiny give insurance executives the fuel they need to build a foundation for innovation in their organization? We’ll find out. Meanwhile, to get a better picture of industry platform use and technology trends, be sure to download Majesco’s latest thought-leadership report, Insurance Digital Transformation: A New Era of Core Systems, Next Gen Technologies and Ecosystems.

*Furtado, Karen, P&C Core Systems Purchasing Trends: Foundational Technology to Fuel the Transformation Journey, Strategy Meets Action (SMA), May 16, 2019