It’s being called the biggest technological breakthrough since the Internet.

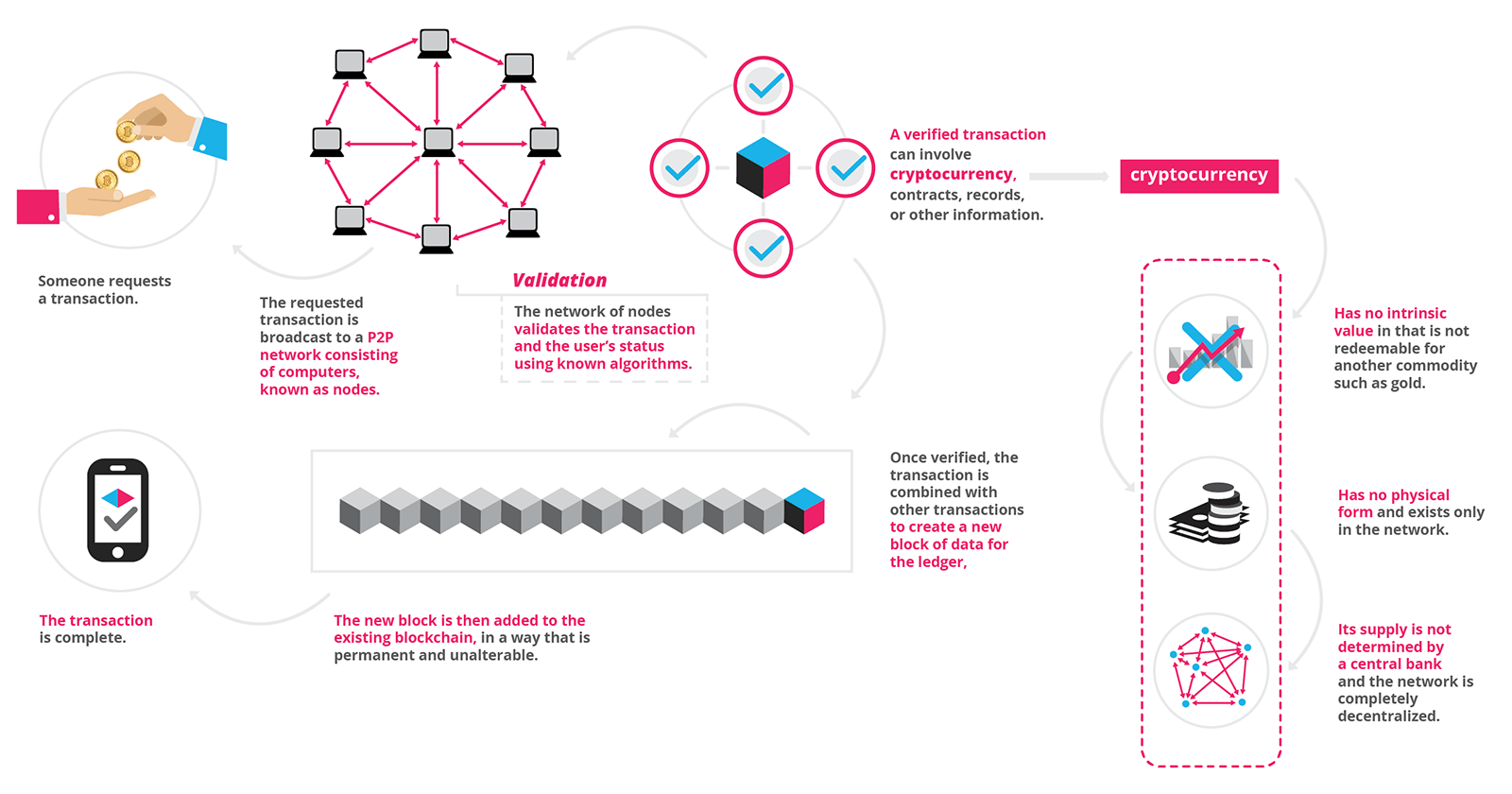

Blockchains are the Internet protocols for allocating scarce resources. By allowing digital information to be distributed but not copied, blockchain technology created the backbone of a new type of internet. Originally devised for digital currency, the tech community is now finding other potential uses for the technology – including insurance.

Blockchain technology can change the way insurance companies connect with customers. This will have broad impacts on distribution, fraud prevention, underwriting, and claims; Blockchain can also improve efficiencies and drive down the cost of transactions.

We’ve compiled a list of top resources as it relates to blockchain, digital insurance and InsurTech:

Articles

- BLOCKCHAIN, EXPLAINED

- Blockchain explained in plain English

- Blockchain explained… in under 100 words

- Understanding blockchain technology, bitcoins and the rise of cryptocurrency

- Chain Reaction: How Blockchain Technology Might Transform Wholesale Insurance

- Blockchain Accelerates Insurance Transformation

- What your company needs to know about the blockchain movement

- The Present Use and Promise of Blockchain in Insurance

- Aigang Lays Groundwork for Future Proof Digital Insurance Protocol on Blockchain

- Blockchains Get Into the Catastrophe Business

- Harnessing blockchain technology for digital transformation

- Blockchain disruption: Insurance companies must smarten up to keep up

- Introducing the Third Wave of Peer-to-Peer Insurance

- Insurance firms tap blockchain for ease of transaction

- The Primary Challenge To Blockchain Technology

- Blockchain: The Invisible Technology That’s Changing the World

- Blockchain and Smart Contracts: Revolutionising the Insurance Industry

- Insurance Industry to be changed by blockchain technology

- Insurance business will see biggest impact from blockchain

- Chain Reaction: How Blockchain Technology Might Transform Wholesale Insurance

InsurTech Startup Companies (*blockchain)

- Trov

- Cover

- Sure

- Metromile

- Cuvva

- Lemonade*

- Hippo

- Swyfft

- Slice Labs

- Next Insurance

- Bunker

- Ladder

- Fabric

- Dynamis

- InsureETH*

- Teambrella*

- Tomorrow

- SafeShare*

- Etherisc*

- Everledger*

- Plex*

LinkedIN Groups (Focus on Blockchain & Business/Insurance)

- TECH | New Blockchain Companies, Technologies and Developments

- Logistics & Supply Chain Technology Innovations, Blockchain/DLT, IoT, Big Data, AI & RobotsInsurance Blockchain

- HyperLedger Project (Blockchain Technologies for Business)

- Distributed Ledgers (Blockchain) in Insurance

- Decentralized Applications & Blockchain Trends

- Blockchain, Distributed Ledgers and Smart Contracts for Business

- Blockchain, Complexity & P2P Insurance

- Blockchain Technology, Distributed Ledger and Financial Services

- Blockchain Professionals, Decentralized Apps & Cryptocurrency

- BLOCKCHAIN Professional Network

- Blockchain Network

- Blockchain Lab

- Blockchain health insurance

- Blockchain For Reinsurance & Insurance Consortium (BRIC)

- Blockchain for Business (Blockchain & Hyperledger Project)

- Blockchain Executive

- BLOCKCHAIN BUSINESS

- Blockchain & IOT for Insurance

- Blockchain & Distributed Ledger Technology (DLT)

- Blockchain Professionals & Developers: Smart Contracts, Ethereum, Bitcoin, MoIP & Cryptocurrencies

For more resources and details – or to be added to this list – contact us info@sviaccelerator.com

Silicon Valley Insurance Accelerator (SVIA) is the insurance industry’s first open innovation lab. Our mission is to change the risk profile of the world through new InsurTech products and solutions. SVIA’s Innovation Platform and Ecosystem helps members learn about, develop and leverage next-gen digital insurance technologies. To learn more or become a member, visit sviaccelerator.com