Competing For The Newest Generations of P&C Insurance Buyers

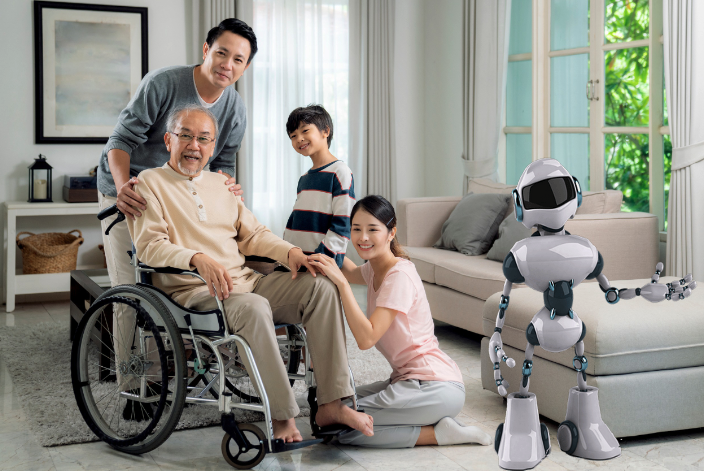

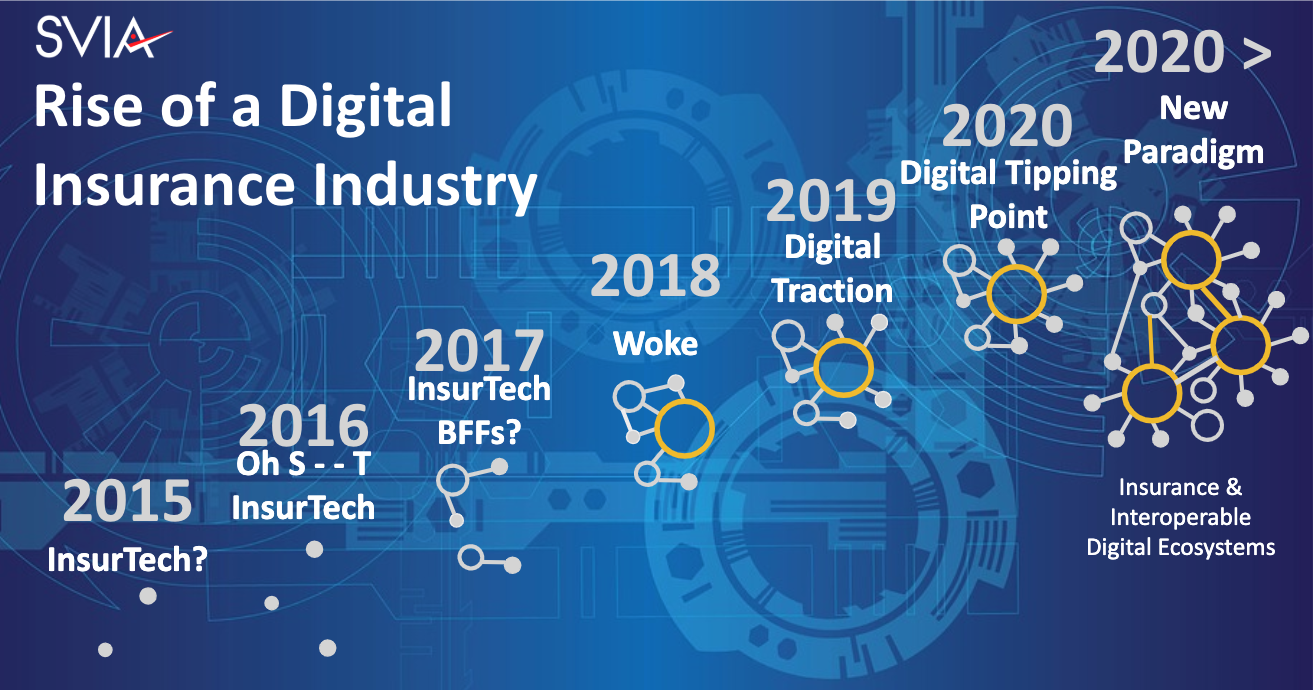

What will it take to Survive & Thrive in the New Insurance Paradigm: Insights from our June Summit

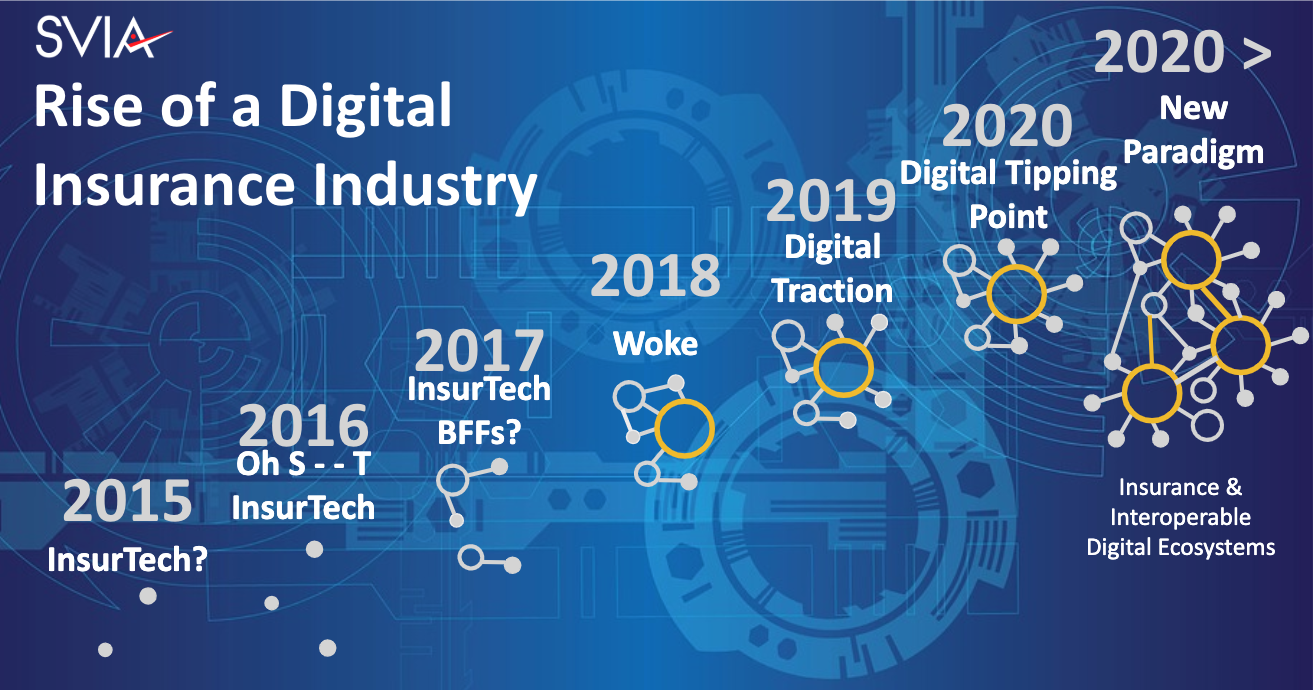

A new paradigm composed of digital ecosystem enabled solutions and business models is fast approaching. That new paradigm will be composed of Insurance solutions that are Faster, Hyper-Connected, and Incredibly Intelligent. Those solutions will be Interactive components of the digital ecosystems surrounding us. They will work interactively to safeguard our families, businesses, communities, and nations. And, they will proactively identify emerging risks and decisions that optimize outcomes transparent and actionable at and between those levels,

Insurers need to be Fearless, Flexible, have fun, and learn to fail fast if they expect to survive. Leading brokers are on the hunt for carriers that can help them deliver these next-generation customer-centric solutions.

[This is a multi-part series covering blockchain technology and its transformative impact on the insurance industry. In part 1, we reviewed the WHY and WHAT of blockchain. In part 2, we discuss smart contracts and their implications on the entire insurance value chain.]

The concept of smart contracts dates back to 1994, when Nick Szabo – a cryptographer widely credited with laying the groundwork for bitcoin – first created the term “smart contract.” A smart contract is essentially a computer program set up with all the conditions agreed to by the parties involved and can automatically execute the terms of a contract. Like normal contracts they help you exchange money, property, shares, or anything of value but do so in a transparent, conflict-free way while avoiding the services of a middleman. For example, pharmaceutical and medical device companies have used software programmed with a contract’s conditions to monitor ERP and other systems and issue rebates and chargebacks depending on their sales channels meeting or exceeding certain conditions.

[This is a multi-part series covering blockchain technology and its transformative impact on the insurance industry. In part 1, we review the WHY and WHAT of blockchain. In part 2, we discuss HOW this new technology can potentially revolutionize insurance.]

Like many articles touting to explain blockchain, it would be easy to just dive straight into the technology, but that would be a disservice. It would not address the larger question of “Why” – Why is blockchain suddenly so hot? Why is it being touted as the next “Big Thing”?

Marik Brockman, Vice President Strategy & Innovation, CSAA

Mega trends including changing economies, demographics, customer expectations and values, and emerging technologies such as mobile, big data